Emergence of Smart Devices and IoT

The emergence of smart devices and the Internet of Things (IoT) is reshaping the landscape of the Shutter Image Sensor Market. As more devices become interconnected, the need for advanced imaging solutions is becoming increasingly apparent. Smart home devices, wearables, and IoT-enabled cameras are driving the demand for compact and efficient shutter image sensors. Market forecasts indicate that the IoT market could surpass 1 trillion USD by 2025, with imaging technologies playing a vital role in this growth. The integration of shutter image sensors into these devices not only enhances functionality but also improves user experience, thereby creating new opportunities for manufacturers in the sensor market.

Expansion of Automotive Imaging Systems

The expansion of automotive imaging systems is significantly influencing the Shutter Image Sensor Market. With the automotive sector increasingly integrating advanced driver-assistance systems (ADAS), the demand for high-quality imaging sensors is on the rise. These sensors are essential for functionalities such as lane departure warnings, parking assistance, and collision avoidance systems. Recent estimates suggest that the automotive imaging market could reach 5 billion USD by 2025, driven by the need for enhanced safety and automation in vehicles. As manufacturers strive to meet regulatory standards and consumer expectations, the incorporation of shutter image sensors in automotive applications is likely to accelerate, further propelling market growth.

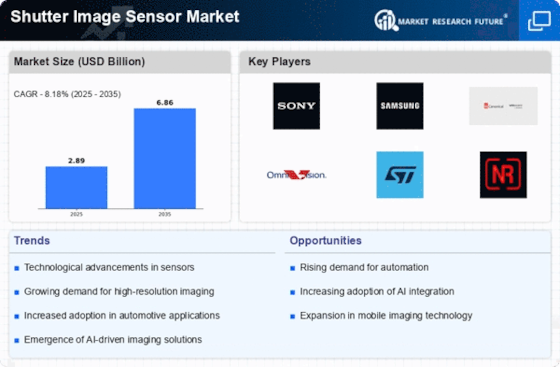

Rising Demand for High-Resolution Imaging

The demand for high-resolution imaging solutions is a pivotal driver in the Shutter Image Sensor Market. As consumers increasingly seek superior image quality in devices such as smartphones, tablets, and cameras, manufacturers are compelled to enhance their offerings. The market has seen a notable shift towards sensors that support higher resolutions, with 48MP and 64MP sensors becoming more prevalent. This trend is not only limited to consumer electronics but also extends to professional photography and videography, where image clarity is paramount. Market analysis indicates that the high-resolution segment is expected to grow at a compound annual growth rate of over 10% in the coming years, reflecting the escalating consumer expectations for quality.

Increased Adoption of Surveillance Systems

The increased adoption of surveillance systems is a notable driver in the Shutter Image Sensor Market. As security concerns continue to rise, both residential and commercial sectors are investing in advanced surveillance technologies. Shutter image sensors play a crucial role in enhancing the quality and reliability of surveillance footage. The market for security cameras, which heavily relies on these sensors, is projected to grow significantly, with estimates suggesting a value of over 10 billion USD by 2027. This growth is attributed to the demand for high-definition video and real-time monitoring capabilities, which are essential for effective security solutions. Consequently, the proliferation of surveillance systems is expected to bolster the demand for shutter image sensors.

Technological Innovations in Imaging Technology

The Shutter Image Sensor Market is currently experiencing a surge in technological innovations, particularly in sensor design and performance. Advancements in pixel technology, such as back-illuminated sensors, have enhanced light sensitivity and image quality. This has led to a growing adoption of shutter image sensors in various applications, including smartphones and digital cameras. According to recent data, the market for image sensors is projected to reach approximately 20 billion USD by 2026, driven by these innovations. Furthermore, the integration of advanced materials and manufacturing techniques is likely to improve the efficiency and reduce the costs associated with sensor production, thereby expanding the market's reach across different sectors.