Expansion of Port Infrastructure

The expansion of port infrastructure is a critical factor influencing the Global Shore Power Market Industry. As global trade continues to grow, ports are investing in modernizing their facilities to accommodate larger vessels and enhance operational efficiency. This modernization often includes the installation of shore power systems, which provide vessels with the necessary electrical supply while at berth. Such investments not only improve the environmental footprint of port operations but also attract more shipping lines seeking to comply with environmental regulations. Consequently, this trend is likely to bolster the market's growth trajectory in the coming years.

Growing Adoption of Electric Vessels

The growing adoption of electric vessels is a significant driver for the Global Shore Power Market Industry. As shipping companies transition towards electrification to reduce operational costs and emissions, the demand for shore power infrastructure is expected to rise. Electric vessels require reliable shore power connections to recharge their batteries while docked, thereby creating a symbiotic relationship between the two sectors. This trend is anticipated to contribute to the market's growth, with projections indicating a market size of 3.2 USD Billion by 2035, reflecting the increasing reliance on electric propulsion in maritime operations.

Increasing Environmental Regulations

The Global Shore Power Market Industry is experiencing a notable surge due to the increasing environmental regulations imposed by governments worldwide. These regulations aim to reduce greenhouse gas emissions from ships while docked, thereby promoting cleaner air quality in port cities. For instance, the International Maritime Organization has set ambitious targets for reducing emissions, which has led to a growing demand for shore power solutions. As a result, the market is projected to reach 1.12 USD Billion in 2024, with a significant portion of this growth attributed to compliance with these stringent regulations.

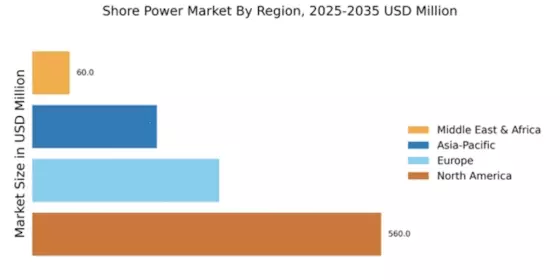

Increased Awareness of Sustainability

Increased awareness of sustainability among stakeholders in the maritime industry is driving the Global Shore Power Market Industry forward. Shipping companies, port authorities, and regulatory bodies are increasingly recognizing the importance of reducing carbon footprints and promoting sustainable practices. This heightened awareness has led to a greater emphasis on implementing shore power solutions, which enable vessels to operate without using onboard generators while docked. As a result, the market is poised for robust growth, with a projected compound annual growth rate of 10.0% from 2025 to 2035, as stakeholders prioritize sustainability in their operational strategies.

Technological Advancements in Power Supply

Technological advancements play a pivotal role in the expansion of the Global Shore Power Market Industry. Innovations in power supply systems, including the development of high-efficiency transformers and smart grid technologies, enhance the reliability and efficiency of shore power solutions. These advancements not only facilitate the seamless transfer of electrical power from the shore to vessels but also contribute to cost reductions for port operators. The integration of renewable energy sources into shore power systems further supports sustainability goals, making these technologies increasingly attractive to stakeholders in the maritime sector.