Regulatory Compliance

Regulatory compliance is increasingly influencing the Shelf Ready Packaging Market. Governments and regulatory bodies are implementing stringent guidelines regarding packaging materials and labeling, aimed at ensuring consumer safety and environmental protection. This regulatory landscape compels manufacturers to adopt shelf ready packaging that not only complies with these regulations but also enhances product appeal. As a result, companies are investing in research and development to create packaging solutions that meet regulatory standards while also being marketable. The emphasis on compliance is expected to drive innovation and growth within the shelf ready packaging sector.

Technological Innovations

Technological advancements play a crucial role in shaping the Shelf Ready Packaging Market. Innovations in printing technology, materials science, and design software are enabling manufacturers to create more efficient and attractive packaging solutions. For instance, the integration of smart packaging technologies, such as QR codes and augmented reality, enhances consumer engagement and provides additional product information. This technological evolution is likely to drive market growth, as companies leverage these advancements to differentiate their products. The market is projected to expand significantly, with technological innovations being a key factor in attracting both manufacturers and consumers.

Sustainability Initiatives

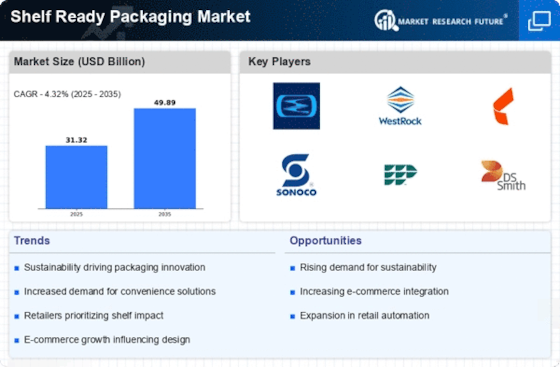

Sustainability has emerged as a pivotal driver in the Shelf Ready Packaging Market. With heightened awareness regarding environmental issues, both consumers and companies are prioritizing eco-friendly packaging solutions. The industry is witnessing a shift towards materials that are recyclable and biodegradable, aligning with global sustainability goals. Reports suggest that the demand for sustainable packaging is expected to grow at a compound annual growth rate of 5% over the next five years. This trend compels manufacturers to innovate and adopt shelf ready packaging that not only meets aesthetic and functional requirements but also adheres to sustainability standards.

Increased Retail Competition

The Shelf Ready Packaging Market is experiencing a surge in competition among retailers, which drives the demand for innovative packaging solutions. Retailers are increasingly focused on enhancing the shopping experience, leading to a preference for shelf ready packaging that is easy to display and attracts consumer attention. This trend is reflected in the growing number of products utilizing shelf ready packaging, which is projected to reach a market value of approximately 50 billion dollars by 2026. As retailers strive to differentiate themselves, the adoption of shelf ready packaging becomes a strategic imperative, allowing them to optimize shelf space and improve product visibility.

Consumer Demand for Convenience

In the Shelf Ready Packaging Market, there is a notable shift in consumer preferences towards convenience-oriented products. As consumers lead increasingly busy lifestyles, they seek packaging that facilitates easy access and quick consumption. Shelf ready packaging meets this demand by providing products that are not only visually appealing but also easy to open and use. This trend is supported by data indicating that nearly 70% of consumers prefer products that offer convenience in their packaging. Consequently, manufacturers are investing in shelf ready packaging solutions to cater to this growing consumer expectation, thereby enhancing their market position.