Surge in Geriatric Population

The surge in the geriatric population is significantly influencing the Sheath Dilator Market. As individuals age, they often experience a higher incidence of health issues, including those requiring urological interventions. The World Health Organization indicates that the global population aged 60 years and older is expected to reach 2 billion by 2050. This demographic shift necessitates the development and availability of medical devices tailored to the needs of older patients. Sheath dilators are essential in various procedures, making them increasingly relevant in geriatric care. The growing emphasis on improving the quality of life for elderly patients is likely to drive demand for sheath dilators, thereby contributing to the expansion of the market.

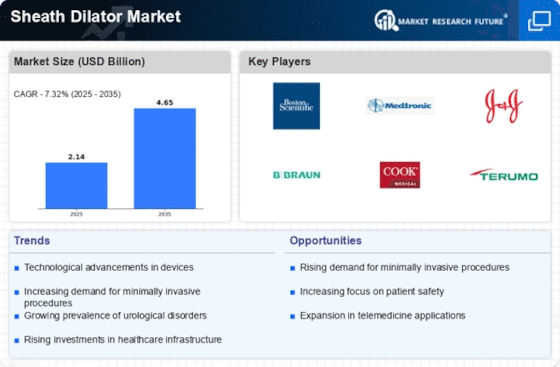

Advancements in Medical Technology

Advancements in medical technology are a pivotal driver for the Sheath Dilator Market. Innovations in materials and design have led to the development of more efficient and user-friendly sheath dilators. These advancements enhance the safety and effectiveness of urological procedures, making them more appealing to healthcare providers. For instance, the introduction of hydrophilic coatings and flexible designs has improved the ease of use and patient comfort. As healthcare facilities increasingly adopt these advanced technologies, the demand for high-quality sheath dilators is expected to rise. Furthermore, the integration of digital solutions in medical devices may also play a role in streamlining procedures, thereby positively impacting the Sheath Dilator Market.

Regulatory Support for Medical Devices

Regulatory support for medical devices is a crucial driver for the Sheath Dilator Market. Governments and regulatory bodies are increasingly recognizing the importance of ensuring the safety and efficacy of medical devices. This support often translates into streamlined approval processes and incentives for innovation. As regulations evolve, manufacturers of sheath dilators are likely to benefit from clearer guidelines and faster pathways to market entry. This environment encourages the development of new and improved products, which can enhance competition and drive growth within the industry. The proactive stance of regulatory agencies may foster a more dynamic Sheath Dilator Market, ultimately benefiting healthcare providers and patients alike.

Increasing Prevalence of Urological Disorders

The rising incidence of urological disorders, such as kidney stones and urinary incontinence, is a notable driver for the Sheath Dilator Market. As these conditions become more prevalent, the demand for effective treatment options increases. According to recent data, urological disorders affect millions of individuals worldwide, leading to a growing need for medical interventions. Sheath dilators play a crucial role in facilitating various urological procedures, thereby enhancing patient outcomes. The increasing awareness of these disorders and the importance of timely treatment further propels the market. Healthcare providers are likely to invest in advanced medical devices, including sheath dilators, to improve procedural efficiency and patient care. This trend suggests a robust growth trajectory for the Sheath Dilator Market in the coming years.

Growing Awareness of Minimally Invasive Techniques

The growing awareness of minimally invasive techniques is driving the Sheath Dilator Market. Patients and healthcare providers alike are increasingly recognizing the benefits of such procedures, including reduced recovery times and lower risk of complications. Sheath dilators are integral to many minimally invasive urological interventions, facilitating smoother operations and enhancing patient outcomes. As more practitioners adopt these techniques, the demand for sheath dilators is likely to increase. Educational initiatives and training programs aimed at promoting minimally invasive methods further support this trend. The shift towards these techniques suggests a promising outlook for the Sheath Dilator Market as it aligns with contemporary healthcare practices.