Growing Adoption of IoT Devices

The proliferation of Internet of Things (IoT) devices is significantly influencing the Smartphone Sensors Market. As more devices become interconnected, the need for smartphones to act as central hubs for these devices becomes increasingly apparent. Sensors such as proximity sensors and temperature sensors are essential for facilitating seamless communication between smartphones and IoT devices. Market analysis reveals that the IoT sector is expected to expand rapidly, with projections indicating a market size exceeding 1 trillion dollars by 2026. This growth is likely to drive further innovation in the Smartphone Sensors Market, as manufacturers adapt to the evolving landscape.

Rising Demand for Advanced Features

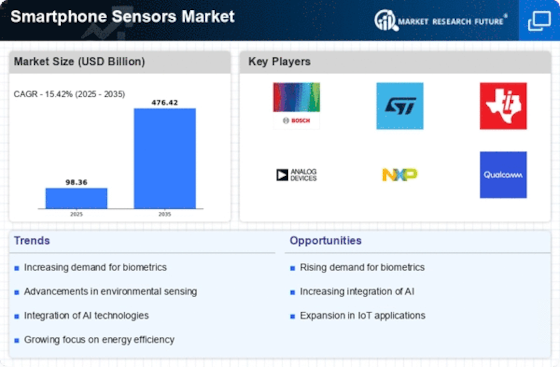

The Smartphone Sensors Market is experiencing a notable surge in demand for advanced features that enhance user experience. As consumers increasingly seek smartphones equipped with sophisticated functionalities, manufacturers are compelled to integrate a variety of sensors. This includes accelerometers, gyroscopes, and ambient light sensors, which collectively contribute to improved device performance. Market data indicates that the demand for multi-functional sensors is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This trend suggests that manufacturers who prioritize sensor integration may gain a competitive edge in the Smartphone Sensors Market.

Rising Health and Fitness Awareness

The increasing awareness of health and fitness among consumers is significantly impacting the Smartphone Sensors Market. As individuals become more health-conscious, the demand for smartphones equipped with health monitoring sensors, such as heart rate monitors and pedometers, is on the rise. Market data indicates that the health and fitness app market is projected to reach 14 billion dollars by 2026, further driving the need for integrated health sensors in smartphones. This trend suggests that manufacturers who prioritize health-related features in their devices may find lucrative opportunities within the Smartphone Sensors Market.

Increased Focus on Security Features

Security concerns are becoming paramount in the Smartphone Sensors Market, prompting manufacturers to enhance the security features of their devices. The integration of biometric sensors, such as fingerprint and facial recognition sensors, is on the rise as consumers demand more secure authentication methods. Recent data suggests that the biometric sensor market is anticipated to reach 30 billion dollars by 2025, reflecting a growing emphasis on security in smartphone design. This trend indicates that manufacturers who invest in advanced security sensors may not only meet consumer expectations but also strengthen their position in the Smartphone Sensors Market.

Technological Advancements in Sensor Technology

Technological advancements are playing a crucial role in shaping the Smartphone Sensors Market. Innovations in sensor technology, such as miniaturization and enhanced sensitivity, are enabling the development of more compact and efficient sensors. These advancements allow for improved functionality in smartphones, including better camera performance and more accurate environmental sensing. Market forecasts suggest that the sensor technology sector is likely to witness a growth rate of around 8% annually, driven by continuous research and development efforts. This evolution in sensor technology is expected to propel the Smartphone Sensors Market forward, as manufacturers strive to incorporate cutting-edge solutions.