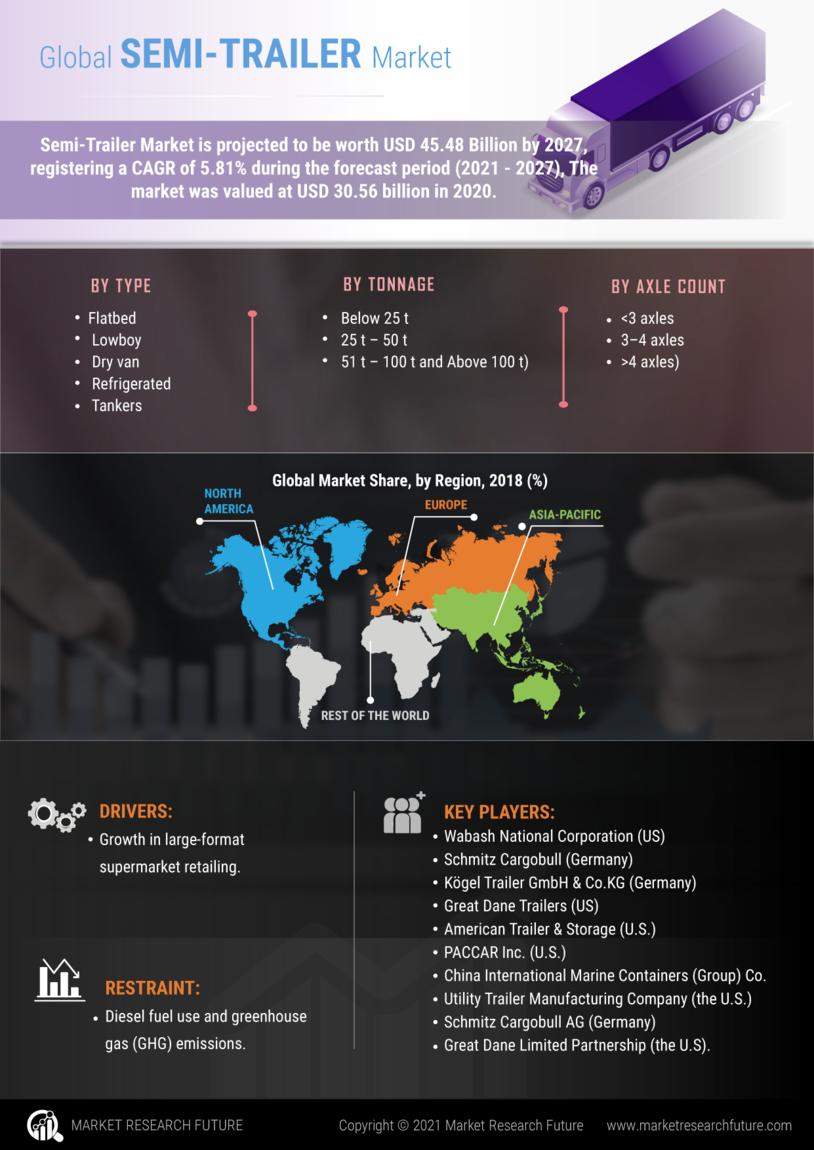

The Semi-Trailer Market is currently characterized by a dynamic competitive landscape, driven by factors such as increasing demand for freight transportation, advancements in trailer technology, and a growing emphasis on sustainability. Major players like Wabash National Corporation (US), Utility Trailer Manufacturing Company (US), and

Schmitz Cargobull AG (DE) are strategically positioning themselves through innovation and regional expansion.

Wabash National Corporation (US) focuses on lightweight trailer designs to enhance fuel efficiency, while Utility Trailer Manufacturing Company (US) emphasizes durability and customization in its offerings. Schmitz Cargobull AG (DE) is leveraging its strong European presence to expand into emerging markets, thereby shaping a competitive environment that prioritizes technological advancement and customer-centric solutions. In terms of business tactics, companies are increasingly localizing manufacturing to reduce lead times and optimize supply chains.

The market appears moderately fragmented, with several key players exerting influence over specific regions. This fragmentation allows for niche players to thrive, while larger companies consolidate their market share through strategic partnerships and acquisitions. The collective influence of these key players fosters a competitive structure that encourages innovation and responsiveness to market demands.

In August 2025, Wabash National Corporation (US) announced a partnership with a leading technology firm to develop smart trailer solutions that integrate IoT capabilities. This strategic move is likely to enhance operational efficiency for fleet operators, as real-time data analytics can optimize route planning and maintenance schedules. Such innovations may position Wabash as a frontrunner in the digital transformation of the semi-trailer sector.

Similarly, in

September 2025, Schmitz Cargobull AG (DE) unveiled a new line of eco-friendly trailers designed to meet stringent emissions regulations. This initiative not only aligns with global sustainability trends but also demonstrates the company's commitment to reducing the carbon footprint of freight transport. By investing in environmentally friendly technologies, Schmitz Cargobull is likely to attract environmentally conscious customers and enhance its competitive edge.

In October 2025,

Utility Trailer Manufacturing Company (US) expanded its production capabilities by opening a new facility in the Midwest. This strategic expansion is expected to improve supply chain efficiency and meet the growing demand for trailers in the region. By localizing production, Utility Trailer can respond more swiftly to customer needs, thereby solidifying its market position.

As of October 2025, the Semi-Trailer Market is witnessing trends such as digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are increasingly shaping the competitive landscape, as companies collaborate to enhance technological capabilities and market reach. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technology integration, and supply chain reliability. This shift underscores the importance of adaptability and forward-thinking strategies in maintaining a competitive advantage.

In September 2025, Ascendance Truck Centers acquired Thompson Truck & Trailer, strengthening its commercial vehicle service and dealership network. The move enhances Ascendance’s regional footprint and improves customer support capabilities. It represents a strategic expansion in the competitive North American trucking market.

In August 2025, Mercedes-Benz set a new world record with its electric semi-truck, showcasing exceptional range and efficiency performance. The achievement highlights Mercedes’ progress in heavy-duty electrification. It reinforces the company’s ambition to lead the zero-emission commercial truck segment.