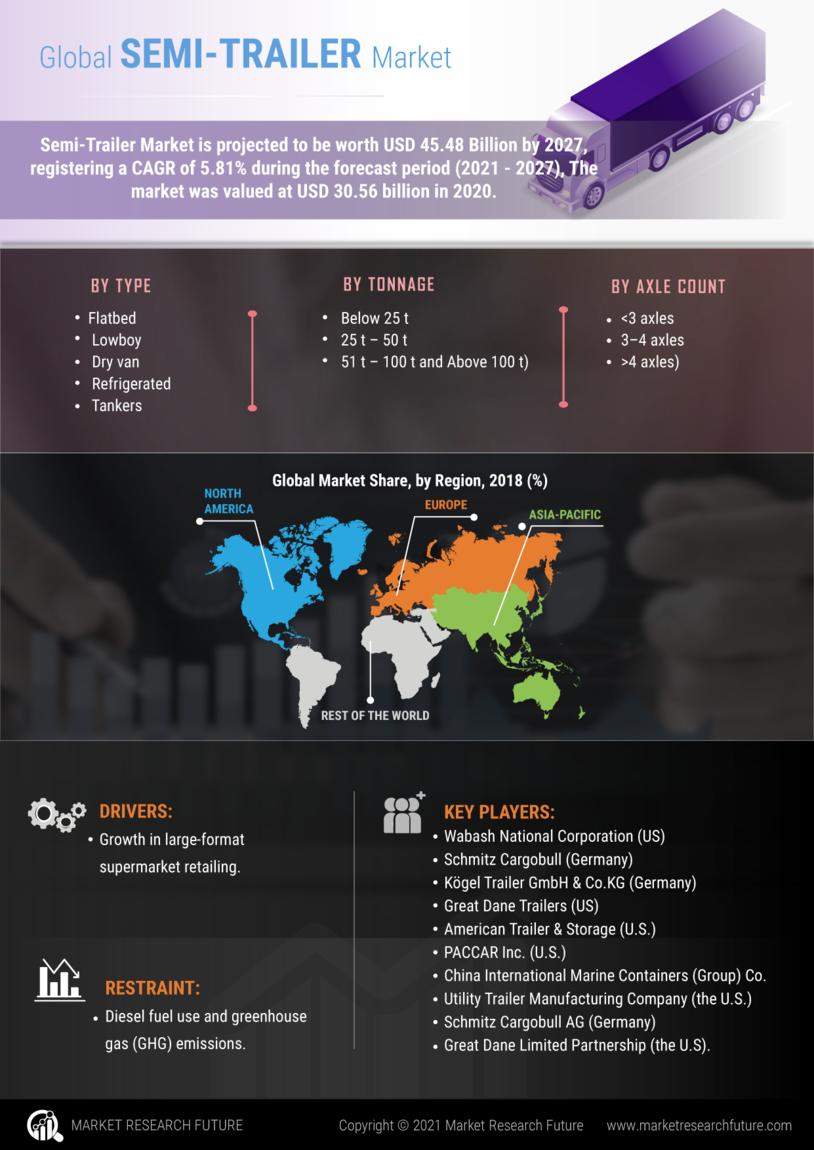

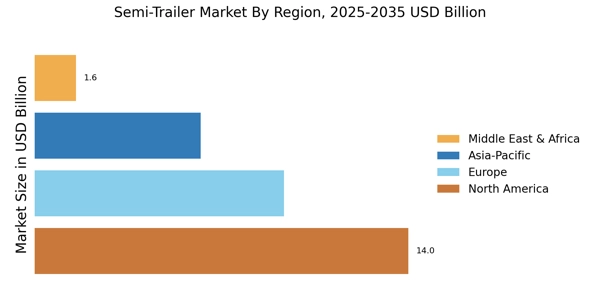

North America : Market Leader in Trailers

North America is the largest market for semi-trailers, accounting for approximately 45% of the global market share. The region's growth is driven by the booming e-commerce sector, increasing freight transportation needs, and stringent regulations promoting safety and efficiency. The U.S. leads this market, followed closely by Canada, which contributes around 15% to the overall market. Regulatory support, such as the Federal Motor Carrier Safety Administration's guidelines, further catalyzes growth.

The competitive landscape in North America is robust, featuring key players like Wabash National Corporation, Utility Trailer Manufacturing Company, and Great Dane Trailers. These companies are innovating with lightweight materials and advanced technologies to enhance fuel efficiency and reduce emissions. The presence of a well-established logistics network and increasing demand for refrigerated trailers also bolster market growth, making it a dynamic environment for semi-trailer manufacturers.

Europe : Emerging Market Dynamics

Europe is witnessing significant growth in the semi-trailer market, holding approximately 30% of the global share. The demand is driven by the increasing need for efficient logistics solutions and the rise of e-commerce. Germany and France are the largest markets, contributing around 12% and 8% respectively. Regulatory frameworks, such as the European Union's Green Deal, are pushing for more sustainable transport solutions, which is expected to further stimulate market growth.

Leading countries in Europe include Germany, France, and the UK, with major players like Schmitz Cargobull AG and Kögel Trailer GmbH dominating the landscape. The competitive environment is characterized by innovation in trailer design and materials, focusing on weight reduction and aerodynamic efficiency. The presence of established manufacturers and a growing emphasis on sustainability are key factors shaping the market dynamics in this region.

Asia-Pacific : Rapidly Growing Market

The Asia-Pacific region is rapidly emerging as a significant player in the semi-trailer market, accounting for about 20% of the global share. The growth is fueled by increasing industrialization, urbanization, and a surge in logistics and transportation activities. China and India are the largest markets, with China alone contributing approximately 12% to the global market.

Government initiatives to improve infrastructure and logistics efficiency are also key growth drivers in this region. China leads the competitive landscape, with numerous local manufacturers entering the market. Key players include major companies like Lufkin Industries and Fontaine Trailer Company, which are expanding their operations to meet rising demand. The region's focus on enhancing supply chain efficiency and the growing trend of e-commerce are expected to further propel the semi-trailer market in the coming years, making it a vibrant and competitive environment.

Middle East and Africa : Untapped Market Potential

The Middle East and Africa (MEA) region is gradually emerging in the semi-trailer market, holding around 5% of the global share. The growth is primarily driven by increasing investments in infrastructure and logistics, alongside a growing demand for efficient transportation solutions. Countries like South Africa and the UAE are leading the market, with South Africa contributing approximately 3% to the global share.

Government initiatives aimed at improving trade routes and logistics capabilities are expected to further enhance market growth. The competitive landscape in MEA is still developing, with several local and international players vying for market share. Key players are focusing on establishing manufacturing facilities to cater to the growing demand. The region's strategic location as a trade hub between continents also presents significant opportunities for semi-trailer manufacturers, making it an attractive market for investment and growth.