Market Growth Projections

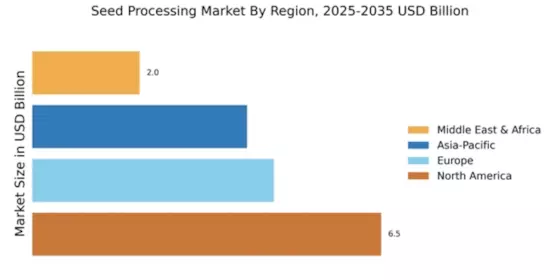

The Global Seed Processing Market Industry is projected to experience robust growth over the coming years. With a market value expected to reach 16.9 USD Billion in 2024 and further increase to 26.5 USD Billion by 2035, the industry is on a promising trajectory. The compound annual growth rate of 4.15% from 2025 to 2035 indicates a sustained demand for seed processing solutions. This growth is likely driven by various factors, including technological advancements, increasing food demand, and supportive government policies. The market's expansion reflects the critical role of seed processing in enhancing agricultural productivity and ensuring food security.

Government Initiatives and Support

Government initiatives aimed at enhancing agricultural productivity are instrumental in propelling the Global Seed Processing Market Industry. Various countries implement policies that promote research and development in seed technology, providing financial support and incentives for seed processing companies. These initiatives foster innovation and encourage the adoption of modern seed processing techniques. As a result, the market is likely to witness substantial growth, with stakeholders benefiting from favorable regulatory environments. Such support not only enhances the competitiveness of the seed processing sector but also aligns with broader agricultural sustainability goals.

Increasing Demand for High-Quality Seeds

The Global Seed Processing Market Industry experiences a notable surge in demand for high-quality seeds, driven by the need for improved crop yields and resistance to pests and diseases. Farmers increasingly recognize that quality seeds are fundamental to achieving optimal agricultural productivity. This trend is reflected in the projected market value of 16.9 USD Billion in 2024, as stakeholders invest in advanced seed processing technologies. Enhanced seed quality not only boosts agricultural output but also contributes to food security, making it a critical focus for agricultural development globally.

Rising Global Population and Food Demand

The Global Seed Processing Market Industry is significantly influenced by the rising global population, which is projected to reach approximately 9.7 billion by 2050. This demographic shift necessitates an increase in food production, thereby driving demand for efficient seed processing solutions. As agricultural practices evolve to meet this challenge, the market is poised for growth, with a compound annual growth rate of 4.15% anticipated from 2025 to 2035. The need for sustainable and high-yielding crops becomes paramount, positioning seed processing as a crucial component in addressing food security concerns worldwide.

Technological Advancements in Seed Processing

Technological innovations play a pivotal role in shaping the Global Seed Processing Market Industry. The introduction of advanced machinery and automated systems enhances the efficiency and effectiveness of seed processing operations. Techniques such as precision seed treatment and genetic modification are gaining traction, allowing for tailored seed characteristics that meet specific agricultural needs. As a result, the market is expected to grow significantly, with projections indicating a value of 26.5 USD Billion by 2035. These advancements not only improve seed quality but also streamline production processes, ultimately benefiting farmers and consumers alike.

Growing Awareness of Sustainable Agriculture Practices

The Global Seed Processing Market Industry is increasingly shaped by the growing awareness of sustainable agricultural practices. Farmers and consumers alike are becoming more conscious of the environmental impact of conventional farming methods, leading to a shift towards organic and sustainable seed production. This trend is reflected in the rising demand for seeds that are processed using eco-friendly techniques. As sustainability becomes a priority, the market is expected to expand, driven by consumer preferences for environmentally responsible products. This shift not only supports ecological balance but also enhances the reputation of seed processing companies committed to sustainable practices.