Economic Growth in Emerging Markets

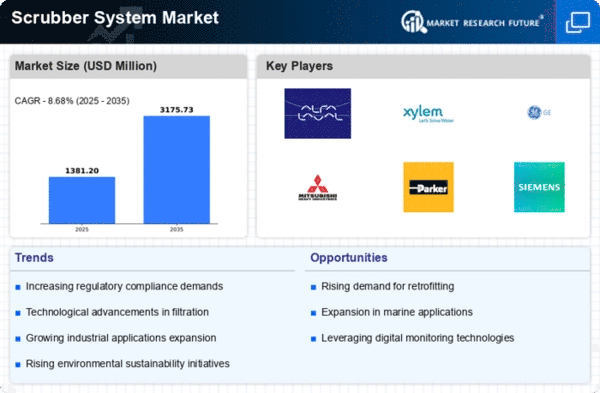

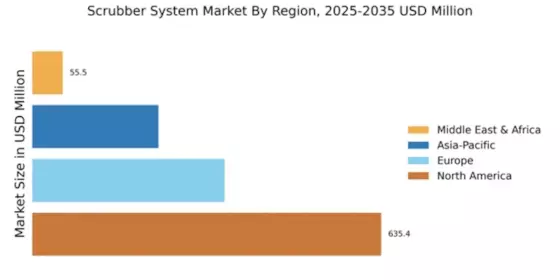

Economic growth in emerging markets is contributing to the expansion of the Global Scrubber System Market Industry. As countries in regions such as Asia-Pacific and Latin America experience rapid industrialization and urbanization, the demand for energy and transportation increases. This growth often leads to higher emissions, prompting governments to implement stricter environmental regulations. Consequently, industries in these regions are investing in scrubber systems to comply with new standards and reduce their environmental footprint. The market's growth is expected to be robust, with a projected CAGR of 8.68% from 2025 to 2035, driven by these emerging market dynamics.

Technological Advancements in Scrubber Systems

Technological innovations are driving the Global Scrubber System Market Industry, as manufacturers develop more efficient and effective scrubber systems. Advancements such as hybrid scrubbers, which can operate in both open and closed loop modes, are gaining traction. These technologies not only enhance performance but also reduce operational costs for end-users. The integration of automation and monitoring systems further optimizes the performance of scrubbers, ensuring compliance with environmental regulations. This trend is expected to contribute to the market's growth, with projections indicating a rise to 3.17 USD Billion by 2035.

Rising Awareness of Environmental Sustainability

There is a growing awareness of environmental sustainability among industries, which is positively influencing the Global Scrubber System Market Industry. Companies are increasingly recognizing the importance of adopting cleaner technologies to minimize their environmental impact. This shift in mindset is prompting investments in scrubber systems, as businesses seek to align with sustainability goals and enhance their corporate social responsibility profiles. The increasing pressure from consumers and stakeholders to adopt environmentally friendly practices is likely to drive the demand for scrubber systems in various sectors, including maritime and industrial applications.

Increasing Maritime Trade and Shipping Activities

The Global Scrubber System Market Industry is closely linked to the growth of maritime trade and shipping activities. As global trade continues to expand, the demand for shipping services increases, leading to a higher number of vessels operating in international waters. This surge in shipping activities necessitates the implementation of scrubber systems to comply with environmental regulations and reduce emissions. The market is likely to benefit from this trend, as more shipping companies invest in scrubber technology to enhance their operational efficiency and meet regulatory requirements.

Regulatory Compliance and Environmental Standards

The Global Scrubber System Market Industry is experiencing heightened demand due to stringent regulatory compliance and environmental standards imposed by governments worldwide. These regulations aim to reduce emissions from marine vessels and industrial processes, thereby promoting cleaner technologies. For instance, the International Maritime Organization has set ambitious targets for reducing sulfur emissions, which has led to increased adoption of scrubber systems. As a result, the market is projected to reach 1.27 USD Billion in 2024, reflecting a growing emphasis on environmental sustainability and compliance with international regulations.