Satellite Solar Panels Array Market Summary

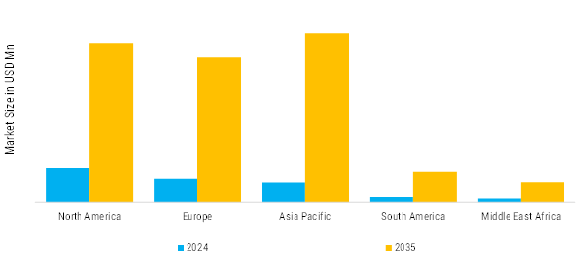

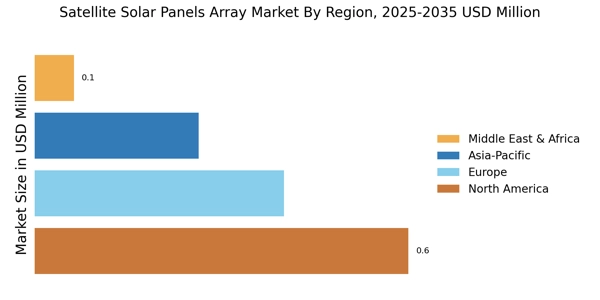

As per Market Research Future analysis, the Satellite Solar Panels Array Market Size was valued at USD 875.02 million in 2024. The Satellite Solar Panels Array Market is projected to grow from USD 841.10 million in 2025 to USD 1,541.25 million by 2035, exhibiting a compound annual growth rate (CAGR) of 6.2% during the forecast period (2025 - 2035).

Key Market Trends & Highlights

The Satellite Solar Panels Array Market is experiencing robust structural trends driven by electrification, sustainability mandates, and supply constraints.

- Eco-friendly missions prioritize recyclable gallium arsenide cells and debris-minimizing designs. Green propellants pair with efficient panels to extend lifespans beyond 10 years.End-of-life power management ensures controlled deorbiting, meeting FCC rules.

- Hybrid systems combine panels with batteries and RTGs for eclipse reliability. Digital twins simulate array performance, reducing qualification tests by 30%. Power beaming tests enable wireless energy transfer between satellites.

- Stricter orbital debris rules mandate 95% power retention post-5 years. Export controls favor allied suppliers for dual-use tech. Spectrum allocation for satcom boosts power needs, spurring array upgrade.

- Machine learning models predict degradation from atomic oxygen and UV, extending array life 20% via real-time reconfiguration.

Market Size & Forecast

| 2024 Market Size | 875.02 (USD Million) |

| 2035 Market Size | 1,541.25 (USD Million) |

| CAGR (2025 - 2035) | 6.2% |

Major Players

Airbus Defence and Space, Spectrolab, Lockheed Martin, Rocket Lab, Inc., Northrop Grumman, Sierra Space, Spacetech GmBH, DHV Technology, Gomspace, ISISpace Group, AAC Clyde Space, Mitsubishi Electric, Thales Alenia Space, mPower Technology, Ascent Solar Technologies, Inc., Leonardo S.p.A., Kongsberg NanoAvionics, and others.