Regulatory Compliance and Standards

Regulatory compliance and standards are increasingly influencing the satellite Cables Assembly Market. Governments and international organizations are establishing stringent guidelines to ensure the quality and safety of satellite communication systems. Compliance with these regulations is essential for manufacturers to maintain market access and consumer trust. The implementation of standardized testing procedures and certifications is becoming commonplace, which may lead to increased operational costs for some companies. However, adherence to these standards can also enhance product reliability and performance, ultimately benefiting end-users. Market analysis suggests that the emphasis on regulatory compliance is likely to shape the competitive landscape of the satellite cables assembly Market, as companies that prioritize quality and compliance may gain a competitive edge.

Increased Demand for Connectivity Solutions

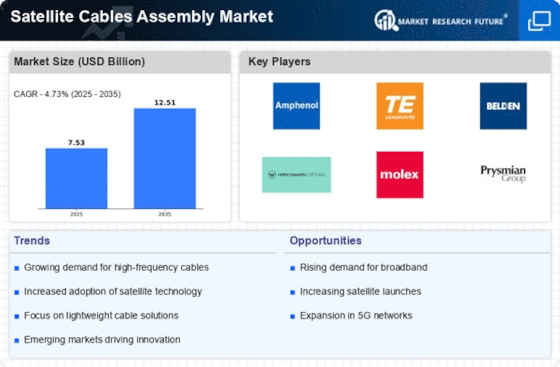

The Satellite Cables Assembly Market is witnessing an increased demand for connectivity solutions driven by the proliferation of digital technologies. As more devices become interconnected, the need for reliable and high-performance satellite communication systems is paramount. This trend is particularly evident in sectors such as telecommunications, broadcasting, and defense, where robust connectivity is essential. Market data suggests that the demand for satellite cables is expected to rise significantly, with projections indicating a growth rate of around 7% annually over the next few years. This surge is likely fueled by the expansion of satellite networks and the increasing reliance on satellite technology for various applications, including internet access in remote areas.

Sustainability Initiatives in Cable Production

Sustainability initiatives are becoming increasingly relevant within the Satellite Cables Assembly Market. Manufacturers are adopting eco-friendly practices, such as using recyclable materials and reducing waste during production. This shift is not only beneficial for the environment but also aligns with the growing consumer preference for sustainable products. Recent studies indicate that companies implementing sustainable practices can enhance their market competitiveness and appeal to environmentally conscious consumers. Additionally, regulatory pressures are prompting manufacturers to comply with environmental standards, further driving the adoption of sustainable practices. As a result, the Satellite Cables Assembly Market is likely to see a rise in demand for products that meet these sustainability criteria, potentially influencing purchasing decisions.

Emerging Markets and Infrastructure Development

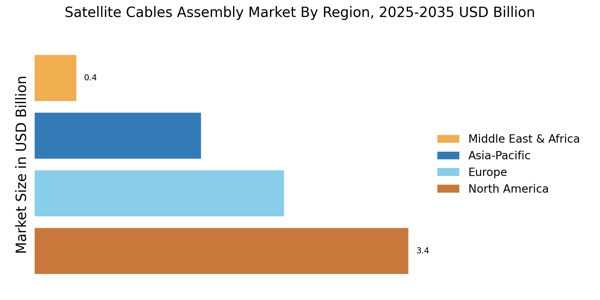

Emerging markets are playing a pivotal role in the growth of the Satellite Cables Assembly Market. As countries invest in infrastructure development, the demand for satellite communication systems is on the rise. This is particularly true in regions where traditional communication infrastructure is lacking or underdeveloped. The expansion of satellite networks in these areas is facilitating better connectivity and access to information. Recent reports indicate that investments in satellite technology in emerging markets could lead to a market growth rate of approximately 8% over the next five years. This trend highlights the potential for satellite cables to bridge the connectivity gap in underserved regions, thereby driving demand in the industry.

Technological Advancements in Satellite Cables Assembly

The Satellite Cables Assembly Market is experiencing a surge in technological advancements that enhance performance and reliability. Innovations in materials, such as low-loss dielectrics and advanced shielding techniques, are being integrated into cable designs. These improvements not only increase signal integrity but also reduce attenuation, which is crucial for high-frequency applications. Furthermore, the advent of new manufacturing processes, including automated assembly techniques, is streamlining production and reducing costs. According to recent data, the market for advanced satellite cables is projected to grow at a compound annual growth rate of approximately 6% over the next five years. This growth is indicative of the industry's response to the increasing demand for high-quality satellite communication solutions.