Sand Screen Size

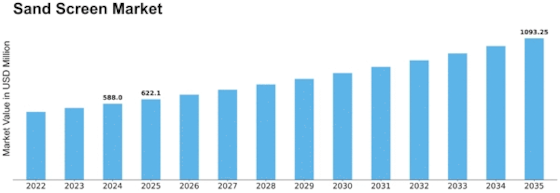

Sand Screen Market Growth Projections and Opportunities

The sand screen market is undergoing significant shifts in its dynamics, influenced by various factors that impact the oil and gas industry, environmental considerations, and technological advancements. Sand screens play a crucial role in oil and gas wells, preventing sand and other particulate matter from entering the production stream. Understanding the market dynamics requires examining how these factors interplay to shape the present and future landscape of the sand screen market.

Technological advancements are a primary driver of change in the sand screen market. Continuous research and development efforts by manufacturers aim to enhance the performance and durability of sand screens. Advanced materials, innovative designs, and manufacturing processes contribute to the development of more efficient and robust sand control solutions. As the industry seeks to optimize well production and maximize reservoir recovery, the demand for cutting-edge sand screen technologies continues to grow.

Environmental considerations also play a crucial role in shaping the sand screen market dynamics. With increasing awareness of the environmental impact of oil and gas operations, there is a growing emphasis on sustainable practices. In response, sand screen manufacturers are developing eco-friendly solutions that align with stringent environmental regulations. The market is witnessing a shift towards more efficient sand control methods that minimize environmental impact and contribute to the overall sustainability of oil and gas extraction processes.

Market dynamics are further influenced by the cyclical nature of the oil and gas industry. Fluctuations in oil prices, geopolitical events, and global economic conditions directly impact exploration and production activities. During periods of low oil prices, operators may scale back drilling activities, affecting the demand for sand screens. Conversely, during periods of increased exploration and production, there is a heightened need for sand control solutions to ensure efficient well operation and prevent sand-related issues.

The geographical distribution of oil and gas reserves also influences the dynamics of the sand screen market. As exploration activities expand into challenging environments, such as deepwater or unconventional reservoirs, the demand for specialized sand control solutions increases. Different regions may exhibit distinct preferences for specific types of sand screens based on geological characteristics, well conditions, and operational requirements, leading to a diversified market landscape.

In addition to these factors, market dynamics are responsive to the overall energy transition and the increasing focus on renewable energy sources. The shift towards cleaner energy options, such as wind and solar, impacts investment decisions in traditional oil and gas projects. This transition can influence the demand for sand screens in oil and gas wells, particularly as the industry adapts to evolving energy trends and strives to balance its role in the broader energy landscape.

In conclusion, the sand screen market dynamics are shaped by a combination of technological advancements, environmental considerations, the cyclical nature of the oil and gas industry, and the evolving energy transition. Manufacturers in this sector must adapt to changing demands by continually innovating their products to meet industry needs. As the oil and gas industry navigates challenges and embraces sustainable practices, the sand screen market is expected to witness further developments in technology and a continued focus on environmental responsibility.

Leave a Comment