Safes Vaults Size

Safes Vaults Market Growth Projections and Opportunities

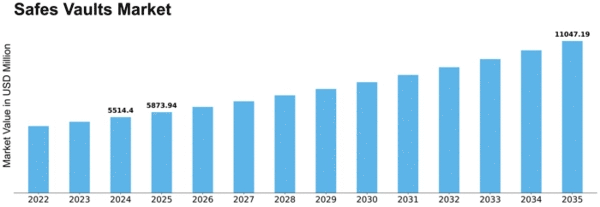

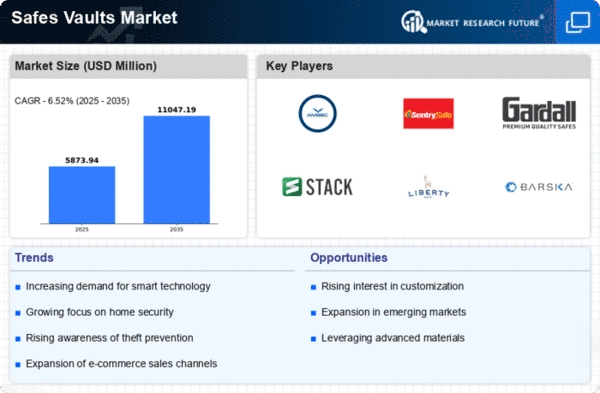

The safes and vaults market worldwide has seen considerable growth in recent years and is expected to reach a valuation of USD 8,541.6 million by the year 2030. This growth is projected to continue at a steady pace, with a Compound Annual Growth Rate (CAGR) of 6.5% from 2022 to 2030. Several key factors contribute to this upward trajectory, including the increasing adoption of electronic and biometric safes, a rise in commercial banks and retail sector activities, and a growing concern about safety due to the surge in crime rates.

One of the significant drivers of the global safes and vaults market is the expanding use of advanced technologies in these security solutions. Electronic and biometric safes and vaults, which utilize digital and unique biological features for authentication, have become increasingly popular. These modern systems offer enhanced security measures and ease of use compared to traditional lock and key mechanisms.

The rise in commercial banks and the retail sector is another factor propelling the growth of the safes and vaults market. As businesses and financial institutions expand, the need for secure storage solutions to protect valuable assets and important documents becomes paramount. Safes and vaults offer a reliable means of safeguarding these assets, contributing to their increased adoption in the commercial sector.

The global surge in crime rates and heightened safety concerns among individuals and businesses have also driven the demand for safes and vaults. As criminal activities evolve, people are seeking more robust and technologically advanced security measures to protect their valuables. Safes and vaults, with their ability to resist unauthorized access and tampering, provide a sense of security in an increasingly uncertain environment.

Furthermore, the market is witnessing new product launches, adding to the array of options available to consumers. Innovations and advancements in technology have led to the introduction of safes and vaults with improved features, making them more secure and user-friendly. This constant innovation presents a prime opportunity for market players to capture a larger share of the growing market.

However, there are challenges that the market faces. The replication of safes and vaults technology at lower costs poses a threat to the industry. Lower-priced alternatives, while more affordable, may compromise on the robustness and security features offered by established brands. This could impact the overall growth of the safes and vaults market as consumers weigh cost against the level of security provided.

The global safes and vaults market is witnessing substantial growth, driven by the increased adoption of electronic and biometric security solutions, the expanding commercial sector, and growing concerns about safety in the face of rising crime rates. The market presents opportunities for manufacturers to introduce innovative products, catering to the evolving needs of consumers. However, the challenge lies in addressing the competition from lower-priced alternatives that may sacrifice security features for affordability. As technology continues to advance, the safes and vaults market is likely to see further developments, ensuring a secure future for those seeking reliable and advanced security solutions.

Leave a Comment