Russia Zeolites Market Summary

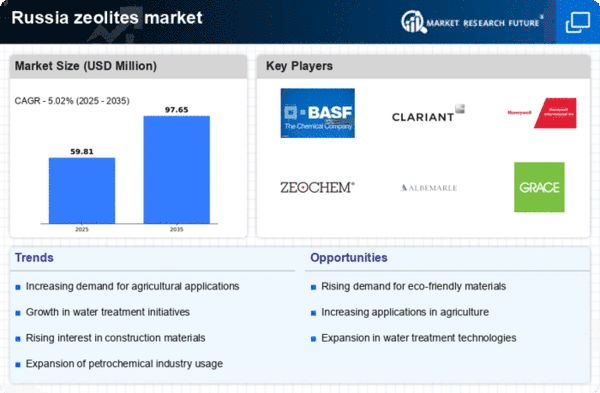

As per Market Research Future analysis, the Zeolites market Size was estimated at 56.95 USD Million in 2024. The zeolites market is projected to grow from 59.81 USD Million in 2025 to 97.65 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 5.0% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Russia zeolites market is experiencing a shift towards sustainable applications and local production growth.

- Sustainable applications are increasingly driving innovation in the Russia zeolites market.

- The agricultural segment remains the largest, while the construction sector is identified as the fastest-growing segment.

- Local production growth is supported by regulatory frameworks that encourage domestic manufacturing.

- Rising demand in agriculture and industrial applications expansion are key drivers of market growth.

Market Size & Forecast

| 2024 Market Size | 56.95 (USD Million) |

| 2035 Market Size | 97.65 (USD Million) |

| CAGR (2025 - 2035) | 5.02% |

Major Players

BASF SE (DE), Clariant AG (CH), Honeywell International Inc. (US), Zeochem AG (CH), Albemarle Corporation (US), W.R. Grace & Co. (US), Tosoh Corporation (JP), KNT Group (RU)