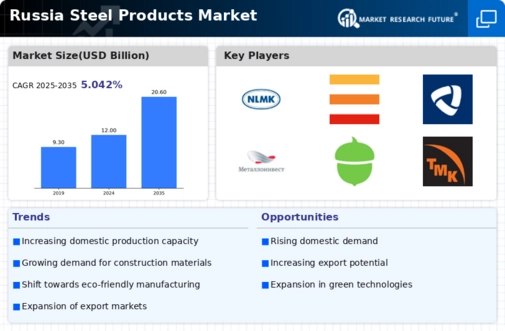

The steel products market is currently experiencing a dynamic phase characterized by evolving demand patterns and technological advancements. The ongoing industrialization efforts and infrastructure projects are likely to drive the consumption of steel products, particularly in construction and manufacturing sectors. Additionally, the emphasis on sustainability and eco-friendly practices may influence production methods, pushing manufacturers to adopt greener technologies. This shift could potentially reshape the competitive landscape, as companies that prioritize environmental responsibility may gain a competitive edge. Moreover, the geopolitical landscape appears to play a crucial role in shaping the steel products market. Trade policies and international relations may impact the availability and pricing of raw materials, thereby affecting production costs. As domestic producers adapt to these changes, there may be a noticeable shift in market dynamics. The focus on innovation and efficiency in production processes is expected to enhance the overall quality of steel products, catering to the diverse needs of various industries. In summary, the steel products market is poised for transformation, driven by both internal and external factors that could redefine its future trajectory.

Sustainability Initiatives

The steel products market is witnessing a growing trend towards sustainability. Manufacturers are increasingly adopting eco-friendly practices, such as recycling and utilizing renewable energy sources. This shift not only aligns with global environmental goals but also meets the rising consumer demand for sustainable products. Companies that prioritize these initiatives may enhance their market position and appeal to environmentally conscious buyers.

Technological Advancements

Innovations in production technologies are significantly influencing the steel products market. Automation and digitalization are streamlining manufacturing processes, leading to increased efficiency and reduced costs. These advancements enable producers to offer higher quality products while maintaining competitive pricing. As technology continues to evolve, it is likely to further transform production capabilities and market dynamics.

Infrastructure Development

Ongoing infrastructure projects are driving demand within the steel products market. Investments in transportation, energy, and urban development are creating a robust need for various steel products. This trend suggests a sustained growth trajectory, as the completion of these projects will likely require ongoing supply of steel materials. Consequently, manufacturers may need to adapt their production strategies to meet this increasing demand.