Geopolitical Tensions

Geopolitical tensions in the region are a significant driver of the Russia Military Laser Rangefinder Market. The ongoing conflicts and security challenges faced by Russia necessitate the development and procurement of advanced military technologies, including laser rangefinders. As military operations become more complex, the need for precise targeting and reconnaissance capabilities has become paramount. The Russian military's strategic focus on enhancing its operational readiness has led to increased investments in laser rangefinder technology. This trend is expected to persist, as the government prioritizes defense initiatives in response to perceived threats. The demand for advanced rangefinders is likely to grow, driven by the need for improved situational awareness and combat effectiveness in various operational environments.

Increased Defense Spending

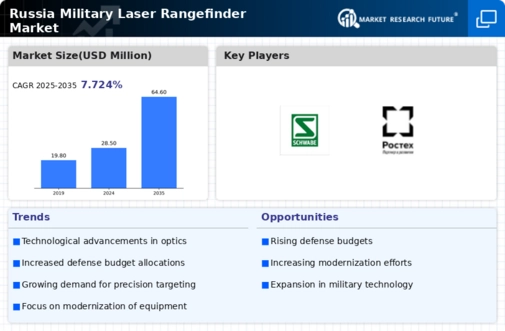

In recent years, the Russian government has significantly increased its defense budget, which has a direct impact on the Russia Military Laser Rangefinder Market. The budget for 2026 is projected to exceed previous years, reflecting a strategic focus on modernizing military capabilities. This increase in funding allows for the procurement of advanced laser rangefinders, which are essential for precision targeting and situational awareness. The emphasis on enhancing the effectiveness of ground and air forces has led to a surge in demand for these devices. Furthermore, the Russian military's commitment to upgrading its existing arsenal indicates a sustained interest in high-tech solutions, thereby driving growth in the laser rangefinder segment. This trend is likely to continue as geopolitical tensions persist, necessitating advanced military technologies.

Technological Advancements

The Russia Military Laser Rangefinder Market is experiencing rapid technological advancements that enhance the capabilities of military operations. Innovations in laser technology, such as improved accuracy and range, are driving demand for advanced rangefinders. The integration of these devices with other military systems, including drones and artillery, is becoming increasingly common. As of January 2026, the Russian Ministry of Defense has allocated significant resources to research and development in this area, indicating a commitment to maintaining technological superiority. The introduction of compact and lightweight designs is also appealing to military personnel, as it enhances mobility and ease of use in various combat scenarios. This trend suggests that the market will continue to evolve, with new features and functionalities being developed to meet the needs of modern warfare.

Focus on Domestic Production

The Russia Military Laser Rangefinder Market is witnessing a strong emphasis on domestic production capabilities. The Russian government has implemented policies aimed at reducing reliance on foreign technology and fostering local manufacturing. This shift is evident in the establishment of partnerships between state-owned enterprises and private companies to develop and produce laser rangefinders. As of January 2026, several domestic manufacturers have emerged, contributing to the growth of the market. This focus on local production not only enhances national security but also stimulates the economy by creating jobs and promoting technological innovation. The government’s support for local industries is likely to result in a more robust supply chain, ensuring that the military has access to cutting-edge technology tailored to its specific needs.

Integration with Modern Warfare Tactics

The integration of laser rangefinders into modern warfare tactics is a crucial driver of the Russia Military Laser Rangefinder Market. As military strategies evolve, the role of precision targeting and real-time data acquisition becomes increasingly vital. Laser rangefinders are being integrated into various platforms, including armored vehicles, artillery systems, and aerial drones, enhancing their operational capabilities. This integration allows for more effective coordination between different military units and improves overall mission success rates. The Russian military's focus on joint operations and combined arms tactics further emphasizes the importance of accurate rangefinding technology. As these tactics continue to develop, the demand for advanced laser rangefinders is expected to rise, reflecting the changing landscape of modern combat.