Growing Electric Vehicle Market

The electric motors market in Russia is significantly impacted by the burgeoning electric vehicle (EV) market. This impact is due to the global shift towards sustainable transportation. With the global shift towards sustainable transportation, Russia is witnessing an increase in the production and adoption of electric vehicles. The government has introduced various incentives to promote EV usage, including subsidies for consumers and investments in charging infrastructure. As a result, the demand for electric motors, which are essential components of electric vehicles, is expected to rise substantially. Industry forecasts suggest that the EV market in Russia could grow by over 25% annually in the coming years. This growth not only stimulates the electric motors market but also encourages innovation in motor technology, as manufacturers strive to develop more efficient and powerful electric motors tailored for the automotive sector.

Government Support and Incentives

The electric motors market in Russia benefits from substantial government support and incentives aimed at promoting domestic manufacturing and technological innovation. The Russian government has implemented various initiatives to bolster the production of electric motors, including tax breaks and subsidies for manufacturers investing in advanced technologies. This support is crucial in fostering a competitive landscape, enabling local companies to enhance their production capabilities and innovate. Furthermore, the government's focus on reducing reliance on imported technologies encourages the development of indigenous electric motor solutions. As a result, the electric motors market is poised for growth, with local manufacturers likely to capture a larger share of the market, thereby stimulating economic development and job creation within the sector.

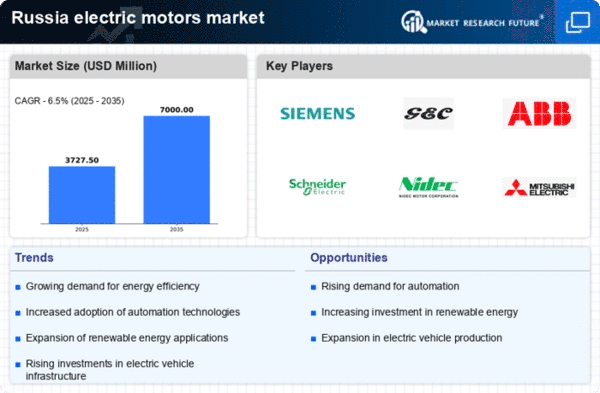

Rising Demand for Energy Efficiency

The electric motors market in Russia experiences a notable surge in demand for energy-efficient solutions. As industries strive to reduce operational costs and comply with stringent energy regulations, the adoption of high-efficiency electric motors becomes paramount. According to recent data, energy-efficient motors can reduce energy consumption by up to 30%, which translates into substantial savings for manufacturers. This trend is particularly evident in sectors such as manufacturing and HVAC, where energy costs constitute a significant portion of operational expenses. The push for energy efficiency aligns with governmental policies aimed at reducing carbon emissions. It also enhances the competitiveness of Russian industries in the global market. Consequently, the electric motors market is likely to witness robust growth driven by this increasing emphasis on energy efficiency.

Expansion of Renewable Energy Sources

The electric motors market in Russia is poised for growth. This growth is due to the expansion of renewable energy sources. As the country seeks to diversify its energy portfolio and reduce dependence on fossil fuels, investments in renewable energy infrastructure are increasing. Wind and solar energy projects, in particular, require efficient electric motors for various applications, including energy conversion and distribution. The Russian government has set ambitious targets for renewable energy generation, aiming for a 4% share of the total energy mix by 2024. This shift towards renewables not only supports environmental sustainability but also drives demand for electric motors designed for renewable applications. As a result, the electric motors market is likely to benefit from this transition, with manufacturers developing specialized products to meet the needs of the renewable sector.

Industrial Automation and Robotics Growth

The electric motors market in Russia is significantly influenced by the rapid growth of industrial automation. Robotics also plays a crucial role in this growth. As industries increasingly adopt automated systems to enhance productivity and efficiency, the demand for electric motors, which are integral components of these systems, is expected to rise. The Russian manufacturing sector, in particular, is undergoing a transformation, with investments in automation technologies projected to increase by approximately 20% over the next few years. This shift not only improves operational efficiency but also positions Russian industries to compete more effectively on a global scale. Consequently, the electric motors market is likely to expand as manufacturers seek to integrate advanced motor technologies into their automated processes.