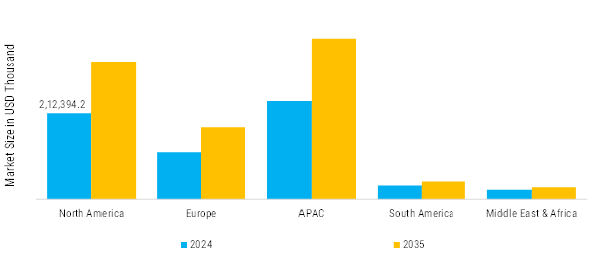

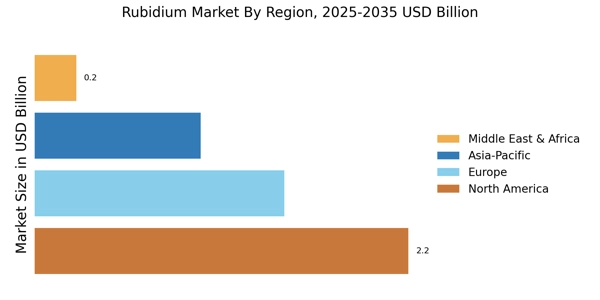

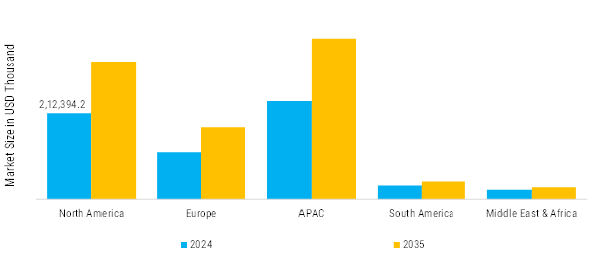

North America:

North America plays a pivotal role in the global rubidium sector, driven by strong demand from its advanced electronics, telecommunications, defense, and research industries. While the U.S. does not actively mine rubidium, it massively depends on imports and by product processing particularly from Canadian pollucite and lepidolite sources. Key applications include atomic clocks for telecom synchronization and GPS, specialty glass for fiber optics, quantum computing, and defense-grade timing devices. The region also hosts major players such as American Elements and Thermo Fisher Scientific, which leverage local R&D and manufacturing capacity to supply high-purity rubidium compounds. According to market research projections, North America holds a significant share of the rubidium market and is expected to grow rapidly, fueled by the increasing adoption of quantum technologies, 5G/6G infrastructure, and energy storage applications.

Europe:

Europe occupies a strategically important niche in the global rubidium sector, driven by strong demand in high precision timing, quantum technologies, and specialty materials. Though the continent lacks major rubidium mining operations, it is a major importer of rubidium compounds especially rubidium carbonate and chloride to serve its advanced electronics, aerospace, and biomedical industries. European firms and research institutions are heavily investing in atomic clocks for satellite navigation (e.g., via ESA) and quantum computing applications, which underpins growing demand for ultra pure rubidium standards. On the regulatory and strategic front, Europe faces supply concentration risks since much of the global rubidium refining capacity lies in China but is also building resilience through R&D, stockpiling, and stronger offtake agreements. Investment in research and satellite navigation systems supports the rubidium atomic clock market across key European countries.

Asia-Pacific:

Asia-Pacific is rapidly emerging as a key growth engine in the global rubidium sector, powered by its booming electronics, telecommunications, and advanced research industries. According to market analyses, the region is projected to grow faster than other regions, driven largely by China, Japan, South Korea, and India. One major factor bolstering demand is Asia's dominance in electronics manufacturing particularly in China where rubidium is used both in specialty glass (for fiber optics) and high precision timing devices.

SOUTH AMERICA:

South America’s role in the global rubidium sector is still nascent but increasingly promising. While large-scale domestic rubidium production remains limited, key countries such as Brazil and Argentina are emerging as potential contributors, particularly via by product recovery from lithium and other rare element mining operations. Demand in the region is being driven by growth in telecommunications infrastructure, especially as Latin American markets modernize their networks and invest in timing and frequency control technologies. Moreover, rubidium compounds like rubidium acetate are projected to see rising consumption in South America, with Brazil accounting for a large portion of regional demand. However, supply-side challenges persist: commercial-scale rubidium mining is rare, and much of the region’s rubidium potential remains tied to the success of rare earth and lithium mining projects. In sum, South America is not yet a major hub for rubidium, but its evolving mining ecosystem and growing technological demand make it a region to watch in the medium to long term.

Middle East and Africa:

The Middle East and Africa currently represent a small but strategically emerging segment in the global rubidium market. Although natural rubidium resources within the region are limited, geologically significant pegmatites in Namibia and Zimbabwe host rubidium bearing minerals, giving Africa latent potential for supply diversification. On the demand side, the region is witnessing rising interest in rubidium for telecommunications, defense systems, and high precision research applications, driven by ongoing infrastructure investments, technological modernization, and increasing R&D activity. In the Middle East, particularly in the Gulf countries, energy sector diversification is also fueling demand for advanced materials, with rubidium-enhanced components being explored for next generation solar and electronic devices.