Top Industry Leaders in the Rubber Processing Chemicals Market

From the tires propelling us down the road to the gaskets sealing our homes, rubber plays a vital role in our modern lives. But its versatility wouldn't be possible without the silent heroes behind the scenes: rubber processing chemicals (RPCs). These unsung additives enhance rubber's strength, elasticity, heat resistance, and more, making it the workhorse material we know and rely on. To navigate this dynamic market, we must delve into the strategies employed by key players, the factors influencing market share, the whispers of recent developments, and the overall pulse of this crucial field. So, prepare to grip your curiosity and embark on a 1000-word exploration where RPCs reign supreme.

From the tires propelling us down the road to the gaskets sealing our homes, rubber plays a vital role in our modern lives. But its versatility wouldn't be possible without the silent heroes behind the scenes: rubber processing chemicals (RPCs). These unsung additives enhance rubber's strength, elasticity, heat resistance, and more, making it the workhorse material we know and rely on. To navigate this dynamic market, we must delve into the strategies employed by key players, the factors influencing market share, the whispers of recent developments, and the overall pulse of this crucial field. So, prepare to grip your curiosity and embark on a 1000-word exploration where RPCs reign supreme.

Strategies Flexing for Market Share:

-

Product Diversification: Leading players like Lanxess, Arkema, and Evonik are expanding beyond traditional RPCs (vulcanizing agents, accelerators, antioxidants) to cater to niche applications. This includes bio-based options, flame retardants, and processing aids, ensuring a foothold in lucrative segments.

-

Geographical Expansion: Asia-Pacific, with its booming automotive and infrastructure industries, is a magnet for market expansion. Companies are establishing local production facilities, forging regional partnerships, and tailoring product offerings to specific rubber types and climatic conditions, solidifying their presence in this high-growth zone.

-

Innovation Pipeline: Continuous research and development are crucial for staying ahead. Companies like Dow Chemical and ExxonMobil are investing heavily in green technologies for RPCs, aiming to reduce environmental impact and capitalize on sustainability concerns.

-

Vertical Integration Vortex: Some players are integrating upstream (raw materials) and downstream (finished rubber products) activities. This enhances control over supply chains, optimizes costs, and provides a competitive edge by offering complete solutions.

-

M&A Mergers: Mergers and acquisitions play a role in market consolidation. For instance, the merger of ChemChina and Pirelli in 2015 strengthened their combined position in the global RPC market, particularly for tire applications.

Factors Shaping the Market's Elasticity:

-

Demand Drivers: The increasing demand for automobiles, coupled with the trend towards larger tires and longer lifespans, fuels the demand for high-performance RPCs. Additionally, the expansion of construction, medical, and consumer goods industries further drives market growth. -

Regulatory Roadblocks: Stringent environmental regulations, particularly in Europe and North America, are pushing for low-VOC (volatile organic compound) and bio-based RPCs. This presents both challenges and opportunities for innovation. -

Price Pressures: Fluctuations in raw material prices (petrochemicals, minerals) due to energy costs and geopolitical factors can impact production costs and profitability for market players. -

Substitute Threats: While RPCs boast unique properties, competition from alternative materials like polyurethane and thermoplastic elastomers can impact market share in specific applications.

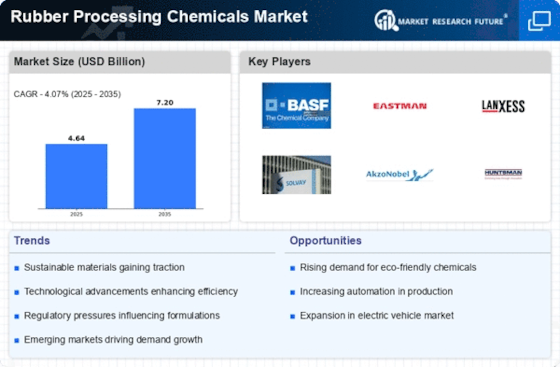

Key Players

Some of the key players in the global rubber processing chemicals are BASF SE (Germany), Lanxess (Germany), Solvay (Belgium), Arkema (France), Eastman Chemical Company (US), Emery Oleochemicals (Malaysia), Henan Xuannuo Imp & Exp Co., Ltd (China), Vanderbilt Chemicals, LLC (US), Merchem Limited (India), PMC Rubber Chemicals India Private Limited, PMC Group, Inc. (India), Nocil Limited (India), and Behn Meyer (Germany).

Recent Developments:

-

October 2023: Lanxess unveils a new range of bio-based vulcanizing agents derived from plant oils, promoting sustainability and reducing reliance on petrochemicals in the industry. -

September 2023: Arkema announces a collaboration with a leading research institute to develop AI-powered predictive maintenance systems for rubber components, optimizing performance and preventing failures. -

August 2023: A class-action lawsuit is filed against a major RPC manufacturer for alleged health risks associated with exposure to certain chemicals, highlighting the importance of safe handling and worker protection. -

July 2023: A consortium of industry players and environmental organizations launch a collaborative initiative to develop and implement closed-loop recycling systems for used rubber and RPCs, promoting a circular economy in the industry.