Rising Environmental Regulations

The Rubber Carbon Black Market is increasingly influenced by stringent environmental regulations aimed at reducing carbon emissions and promoting sustainable practices. Governments worldwide are implementing policies that encourage the use of eco-friendly materials and processes. In 2025, it is projected that compliance with these regulations will drive a shift towards more sustainable carbon black production methods, such as the use of renewable energy sources. This transition may lead to the development of bio-based carbon black alternatives, which could capture a significant market share. As companies adapt to these regulatory changes, the Rubber Carbon Black Market may witness a transformation that aligns with global sustainability goals.

Growth in Construction Activities

The construction industry significantly influences the Rubber Carbon Black Market, as carbon black is used in various applications, including sealants, coatings, and roofing materials. With urbanization and infrastructure development gaining momentum, the demand for construction materials incorporating carbon black is expected to rise. In 2025, the construction sector is anticipated to account for around 25% of carbon black consumption. This growth is driven by the need for durable and weather-resistant materials, which are essential for modern construction projects. As sustainability becomes a priority, the incorporation of carbon black in eco-friendly construction materials may further enhance its market presence, indicating a promising outlook for the Rubber Carbon Black Market.

Expansion of Tire Recycling Initiatives

The expansion of tire recycling initiatives is a crucial driver for the Rubber Carbon Black Market, as it promotes the recovery and reuse of carbon black from used tires. With increasing awareness of environmental issues, many regions are implementing programs to recycle tires, which can yield valuable materials, including carbon black. In 2025, it is estimated that recycled carbon black could account for approximately 10% of the total carbon black supply. This trend not only supports sustainability efforts but also reduces the dependency on virgin carbon black production. As the recycling infrastructure improves, the Rubber Carbon Black Market is likely to benefit from a more circular economy, enhancing its long-term viability.

Technological Innovations in Production

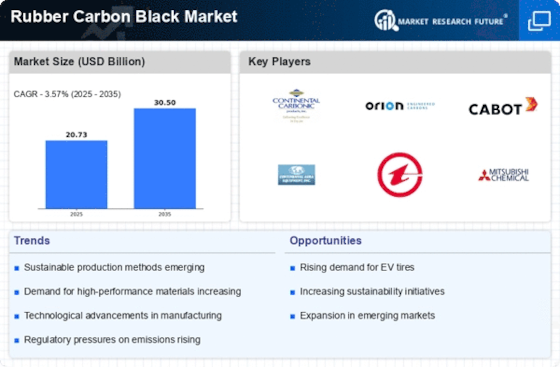

Technological advancements in the production of carbon black are poised to impact the Rubber Carbon Black Market positively. Innovations such as the development of more efficient manufacturing processes and the introduction of alternative feedstocks are likely to enhance production capabilities. In 2025, it is estimated that these advancements could reduce production costs by up to 15%, making carbon black more accessible to various industries. Furthermore, the emergence of new grades of carbon black tailored for specific applications may open new avenues for growth. As manufacturers adopt these technologies, the Rubber Carbon Black Market is expected to experience increased competitiveness and expanded market reach.

Increasing Demand from Automotive Sector

The automotive sector is a primary driver for the Rubber Carbon Black Market, as it utilizes carbon black in tire manufacturing and other rubber components. The demand for high-performance tires, which require specific grades of carbon black, is on the rise. In 2025, the automotive industry is projected to consume approximately 40% of the total carbon black production, reflecting a robust growth trajectory. This trend is fueled by the increasing production of electric vehicles and the need for enhanced tire durability and performance. As manufacturers seek to improve fuel efficiency and reduce emissions, the demand for specialized rubber compounds containing carbon black is likely to escalate, thereby propelling the Rubber Carbon Black Market forward.