Regulatory Frameworks

Regulatory frameworks are increasingly shaping the Roundwood Market, as governments implement stricter guidelines to promote sustainable forestry practices. These regulations often require companies to demonstrate compliance with environmental standards, which can influence sourcing and production methods. In 2025, it is expected that more countries will adopt stringent regulations regarding timber harvesting and trade, impacting the availability of roundwood. Companies that proactively align with these regulations may benefit from enhanced market access and consumer trust. Conversely, those that fail to comply could face significant challenges, including legal repercussions and reputational damage. Thus, navigating the regulatory landscape is becoming crucial for success in the Roundwood Market.

Sustainability Trends

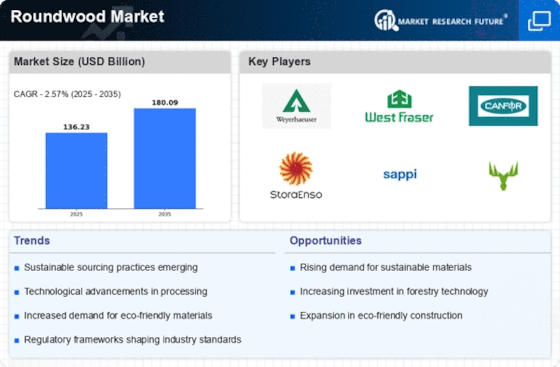

The Roundwood Market is increasingly influenced by sustainability trends, as consumers and businesses alike prioritize environmentally friendly practices. The demand for sustainably sourced roundwood is on the rise, driven by a growing awareness of deforestation and its impact on climate change. In 2025, it is estimated that the market for certified sustainable wood products could reach a valuation of several billion dollars, reflecting a shift towards responsible sourcing. This trend is not only reshaping consumer preferences but also prompting manufacturers to adopt sustainable practices in their operations. As a result, companies that align with these sustainability initiatives are likely to gain a competitive edge in the Roundwood Market, appealing to eco-conscious consumers and businesses.

Technological Innovations

Technological advancements are playing a pivotal role in the Roundwood Market, enhancing efficiency and productivity across various stages of production. Innovations such as precision forestry and automated harvesting equipment are streamlining operations, reducing waste, and improving yield. In 2025, the integration of advanced technologies is projected to increase the overall efficiency of roundwood production by up to 30%. Furthermore, the adoption of digital platforms for supply chain management is facilitating better tracking and transparency, which is becoming increasingly important to consumers. As these technologies continue to evolve, they are likely to redefine operational standards within the Roundwood Market, fostering a more competitive landscape.

Diversification of Applications

The diversification of applications for roundwood is significantly impacting the Roundwood Market. Traditionally used for construction and furniture, roundwood is now finding new uses in sectors such as bioenergy and biocomposites. This shift is driven by the increasing demand for renewable energy sources and sustainable materials. In 2025, it is anticipated that the bioenergy sector will account for a substantial portion of roundwood consumption, as industries seek to reduce their carbon footprint. This trend not only opens new avenues for growth but also encourages innovation in product development. As a result, companies that can adapt to these changing applications are likely to thrive in the evolving Roundwood Market.

Economic Growth and Urbanization

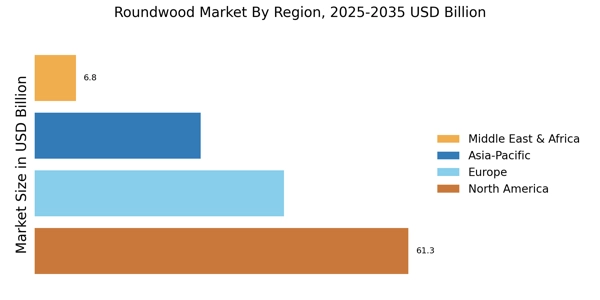

Economic growth and urbanization are driving demand within the Roundwood Market, particularly in developing regions. As urban populations expand, the need for construction materials, including roundwood, is surging. In 2025, it is projected that urbanization will contribute to a significant increase in roundwood consumption, particularly in emerging markets. This trend is further fueled by rising disposable incomes, which enable consumers to invest in housing and infrastructure. However, this growth also poses challenges, such as the need for sustainable sourcing practices to meet the increasing demand without compromising forest ecosystems. Therefore, balancing economic development with environmental stewardship is essential for the future of the Roundwood Market.