Rising Demand for Automation

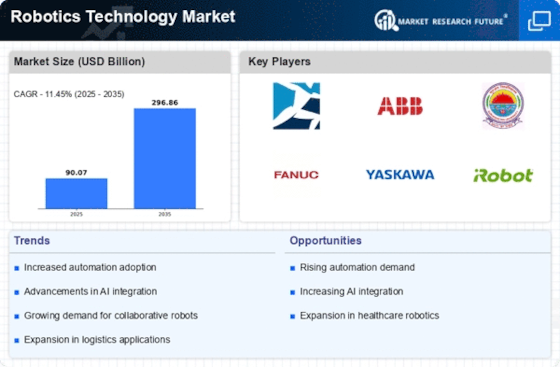

The Robotics Technology Market is experiencing a notable surge in demand for automation across various sectors. Industries such as manufacturing, logistics, and agriculture are increasingly adopting robotic solutions to enhance efficiency and reduce operational costs. According to recent data, the automation market is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This trend is driven by the need for improved productivity and the ability to perform repetitive tasks with precision. As companies seek to remain competitive, the integration of robotics technology becomes essential, leading to a robust expansion of the Robotics Technology Market.

Growing Need for Safety and Compliance

The Robotics Technology Market is increasingly shaped by the growing need for safety and compliance in industrial environments. As automation becomes more prevalent, ensuring the safety of human workers and compliance with regulatory standards is paramount. Robotics technology offers solutions that can mitigate risks associated with hazardous tasks, thereby enhancing workplace safety. The market for safety-focused robotics is projected to expand, with estimates suggesting a growth rate of around 12% in the coming years. This trend reflects a broader commitment to creating safer work environments while leveraging the benefits of automation.

Advancements in AI and Machine Learning

The Robotics Technology Market is significantly influenced by advancements in artificial intelligence and machine learning. These technologies enable robots to perform complex tasks, learn from their environments, and adapt to changing conditions. The integration of AI into robotics is expected to enhance capabilities in areas such as perception, decision-making, and interaction with humans. As a result, the market for intelligent robots is anticipated to grow substantially, with estimates suggesting a potential increase of over 15% in the next few years. This evolution not only improves operational efficiency but also opens new avenues for applications in sectors like healthcare and service industries.

Expansion of Robotics in Service Industries

The Robotics Technology Market is witnessing a significant expansion in service industries, including hospitality, retail, and logistics. Robots are increasingly being deployed for tasks such as customer service, inventory management, and delivery. This trend is driven by the need for improved customer experiences and operational efficiency. Market data indicates that the service robotics segment is expected to grow at a rate of approximately 14% annually over the next few years. As businesses seek to enhance their service offerings and streamline operations, the adoption of robotics technology is likely to become a key strategy in the service sector.

Increased Investment in Research and Development

Investment in research and development within the Robotics Technology Market is on the rise, as companies and governments recognize the potential of robotics to transform various sectors. Funding for innovative projects is expected to reach unprecedented levels, with estimates indicating a growth of over 20% in R&D budgets dedicated to robotics over the next few years. This influx of capital is likely to accelerate the development of new technologies, enhance existing products, and foster collaboration between academia and industry. As a result, the Robotics Technology Market is poised for rapid advancements, leading to more sophisticated and capable robotic systems.