Top Industry Leaders in the Robot software Market

Competitive Landscape of Robot Software Market

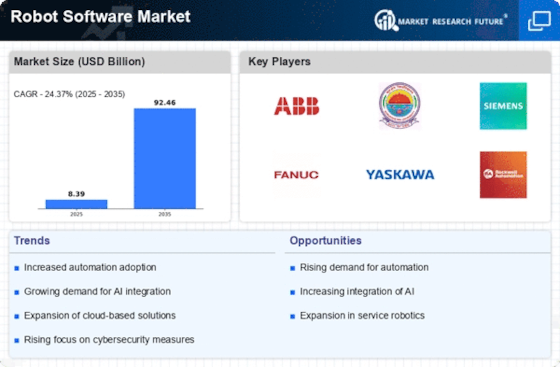

The robot software market is experiencing explosive growth, fueled by surging demand for automation and the rapid advancement of artificial intelligence (AI) and machine learning (ML) technologies. This dynamic landscape is teeming with established players, emerging contenders, and strategic partnerships, all vying for a slice of the lucrative pie.

Key Players:

- IBM Corporation

- ABB Ltd

- Nvidia Corporation

- Cloudminds

- Brain Corporation

- Aibrain

- Furhat robotics

- Neurala

- iRobot

- Epson Robotics

- Microsoft Corporation

- Energid technologies

- Oxbotica

Strategies for Market Domination:

- Product Innovation: Players are constantly innovating, focusing on AI-powered capabilities like autonomous navigation, object recognition, and self-learning. Integration with IoT and big data platforms is also crucial for creating intelligent robots that can adapt to dynamic environments.

- Openness and Collaboration: Open-source software platforms and collaborative robot ecosystems are gaining traction, allowing developers and users to share knowledge and accelerate innovation. This fosters a more vibrant and competitive market.

- Subscription-Based Models: Moving away from traditional licensing models, companies are embracing subscription-based services and pay-as-you-go options. This aligns with customer preferences for flexibility and minimizes upfront costs.

- Industry-Specific Solutions: Tailoring robot software to specific industries, such as healthcare, logistics, and manufacturing, is key to unlocking new markets and addressing unique customer needs.

Factors for Market Share Analysis:

- Product Portfolio Breadth and Depth: The range of robot types and functionalities supported by the software is crucial.

- Technological Advancements: Integration with AI, ML, and other cutting-edge technologies is a key differentiator.

- Deployment Flexibility: Offering cloud-based, on-premises, and hybrid deployment options caters to diverse customer preferences.

- Ease of Use and Integration: User-friendly interfaces and seamless integration with existing systems are essential for adoption.

- Security and Reliability: Robust security features and reliable performance are paramount for mission-critical applications.

- Customer Support and Services: Comprehensive support and training programs ensure customer satisfaction and retention.

New and Emerging Companies:

- Scalable Robotics: Developing software for modular robots that can be easily reconfigured for different tasks.

- Perceptron: Specializing in AI-powered visual perception software for robots.

- Brain Corp: Focusing on robot software for autonomous navigation and object manipulation.

- Osaro: Offering cloud-based robot fleet management software.

Current Investment Trends:

- Venture Capital (VC) Funding: VC firms are pouring billions into robotics and AI startups, fueling innovation and market growth.

- Strategic Partnerships: Established players are partnering with startups and technology providers to access new capabilities and expand their offerings.

- M&A Activity: Mergers and acquisitions are happening to consolidate market share and acquire complementary technologies.

- Focus on AI and ML: Investments in AI and ML research and development are crucial for building the next generation of intelligent robot software.

Recent Developments and Acquisitions:

- Jan 25, 2024: Siemens acquires InOrbit: This acquisition strengthens Siemens' robotics software portfolio with AI-powered robot fleet management capabilities. (Jan 25, 2024).

- Jan 17, 2024: ABB launches RobotStudio v7: The new version of ABB's robot programming software offers improved functionality and ease of use for programmers of all skill levels. (Jan 17, 2024).

- Jan 10, 2024: Amazon invests in Fetch Robotics: The investment aims to accelerate the development and deployment of Fetch's mobile manipulation robots in warehouse and logistics applications. (Jan 10, 2024).

Emerging Technologies and Innovations:

- AI-powered robot vision: Companies like Rethink Robotics and GreyOrange are developing AI vision systems that enable robots to navigate dynamic environments and perform complex tasks.

- Digital twins and robotics: Creating digital twins of robots and their operating environments allows for improved maintenance, optimization, and simulation of robot performance.

- Edge computing for robotics: Deploying edge computing solutions at the robot level reduces latency and improves real-time decision-making capabilities.