North America : Market Leader in Innovation

North America is poised to maintain its leadership in the robot-assisted endoscopes market, holding a significant market share of 3.25 in 2024. The region's growth is driven by advanced healthcare infrastructure, increasing demand for minimally invasive surgeries, and supportive regulatory frameworks. The FDA's proactive stance on robotic technologies further catalyzes market expansion, ensuring rapid adoption and innovation in surgical procedures.

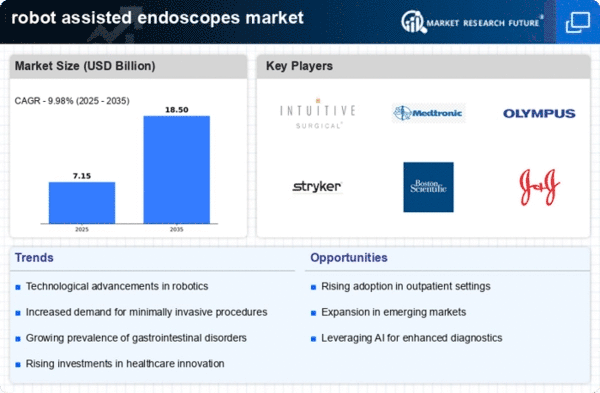

The competitive landscape in North America is robust, featuring key players such as Intuitive Surgical, Medtronic, and Stryker Corporation. These companies are at the forefront of technological advancements, focusing on enhancing surgical precision and patient outcomes. The presence of leading healthcare institutions and research facilities fosters a conducive environment for innovation, making North America a hub for the development and deployment of cutting-edge robotic endoscopic solutions.

Europe : Emerging Market with Growth Potential

Europe is witnessing a burgeoning market for robot-assisted endoscopes, with a market size of 2.0 in 2024. The growth is fueled by increasing healthcare expenditure, a rising geriatric population, and a shift towards minimally invasive surgical techniques. Regulatory bodies in Europe are actively promoting the integration of robotic systems in healthcare, enhancing patient safety and surgical efficiency, which is pivotal for market growth.

Leading countries such as Germany, France, and the UK are at the forefront of this market, supported by strong healthcare systems and significant investments in medical technology. Key players like Olympus Corporation and KARL STORZ SE & Co. KG are driving innovation, focusing on developing advanced robotic systems that improve surgical outcomes. The competitive landscape is characterized by collaborations and partnerships aimed at enhancing product offerings and expanding market reach.

Asia-Pacific : Rapid Growth in Healthcare Sector

The Asia-Pacific region is emerging as a significant player in the robot-assisted endoscopes market, with a market size of 1.75 in 2024. The growth is primarily driven by increasing healthcare investments, a growing population, and rising awareness of advanced surgical technologies. Governments in the region are implementing policies to enhance healthcare infrastructure, which is expected to further boost the adoption of robotic systems in surgical procedures.

Countries like Japan, China, and Australia are leading the charge, with major companies such as Fujifilm Holdings Corporation and Conmed Corporation actively participating in the market. The competitive landscape is evolving, with a focus on innovation and collaboration among key players to meet the rising demand for robotic-assisted surgeries. This trend is expected to continue as the region's healthcare sector expands and modernizes.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa (MEA) region is gradually developing its market for robot-assisted endoscopes, currently valued at 0.5 in 2024. The growth is driven by increasing healthcare investments, a rising prevalence of chronic diseases, and a shift towards advanced surgical techniques. However, challenges such as limited healthcare infrastructure and regulatory hurdles may impede rapid growth. Governments are focusing on improving healthcare access and quality, which is essential for market expansion.

Countries like South Africa and the UAE are leading the market, with efforts to enhance healthcare systems and attract foreign investments. While the presence of key players is still developing, companies are beginning to explore opportunities in this region. The competitive landscape is characterized by emerging partnerships and collaborations aimed at overcoming existing challenges and fostering growth in the robot-assisted endoscopy market.