North America : Market Leader in Repair Services

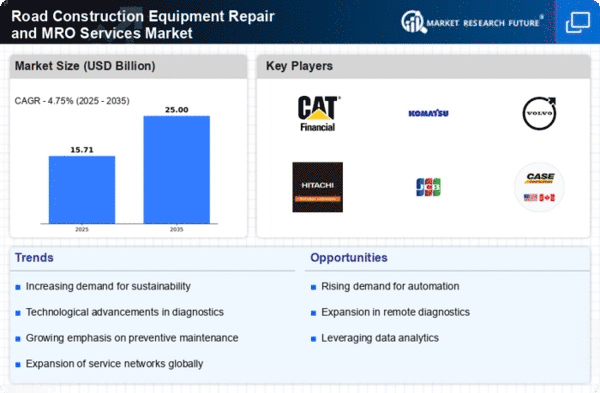

North America is poised to maintain its leadership in the Road Construction Equipment Repair and MRO Services Market, holding a market size of $6.0 billion in 2025. Key growth drivers include increased infrastructure spending, technological advancements, and a rising demand for efficient repair services. Regulatory support for infrastructure projects further catalyzes market expansion, ensuring a robust demand for MRO services across the region. The competitive landscape is characterized by major players such as Caterpillar, CASE Construction Equipment, and Terex Corporation, which dominate the market with innovative solutions and extensive service networks. The U.S. remains the largest contributor, driven by significant investments in road construction and maintenance. This competitive environment fosters continuous improvement and adaptation to emerging technologies, ensuring sustained growth in the sector.

Europe : Emerging Market with Growth Potential

Europe's Road Construction Equipment Repair and MRO Services Market is projected to reach $4.5 billion by 2025, driven by increasing urbanization and stringent environmental regulations. The demand for sustainable practices in construction and repair services is a key growth factor, supported by government initiatives aimed at enhancing infrastructure resilience. Regulatory frameworks are evolving to promote eco-friendly technologies, further stimulating market growth. Leading countries such as Germany, France, and the UK are at the forefront of this market, with a strong presence of key players like Volvo and Liebherr. The competitive landscape is marked by a focus on innovation and sustainability, as companies adapt to changing regulations and consumer preferences. This dynamic environment fosters collaboration between manufacturers and service providers, enhancing service delivery and customer satisfaction.

Asia-Pacific : Rapid Growth in Emerging Economies

The Asia-Pacific region is witnessing significant growth in the Road Construction Equipment Repair and MRO Services Market, projected to reach $3.5 billion by 2025. Key drivers include rapid urbanization, increased government spending on infrastructure, and a growing focus on maintenance services. Countries like China and India are leading this growth, supported by favorable regulatory environments that encourage investment in infrastructure development. The competitive landscape features major players such as Komatsu and Hitachi Construction Machinery, which are expanding their service offerings to meet rising demand. The presence of local players is also increasing, contributing to a diverse market landscape. As the region continues to develop, the emphasis on efficient repair services will be crucial for sustaining growth and enhancing operational efficiency in construction projects.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa region is gradually emerging in the Road Construction Equipment Repair and MRO Services Market, with a projected size of $1.0 billion by 2025. Key growth drivers include increasing investments in infrastructure and urban development projects, alongside a rising demand for efficient repair services. However, challenges such as political instability and economic fluctuations may hinder growth. Regulatory support for infrastructure projects is essential to overcome these obstacles and stimulate market expansion. Countries like the UAE and South Africa are leading the market, with a growing presence of international players such as JCB and Doosan Infracore. The competitive landscape is evolving, with local companies also entering the market to capitalize on emerging opportunities. As the region develops, the focus on enhancing service quality and operational efficiency will be vital for sustained growth in the MRO sector.