North America : Logistics Innovation Leader

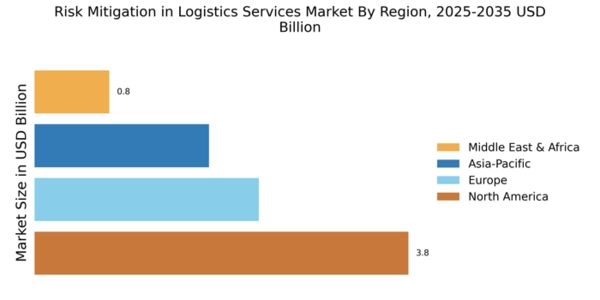

North America leads the Risk Mitigation in Logistics Services Market, holding a significant market share of 3.75 in 2024. The region's growth is driven by advanced technology adoption, stringent regulatory frameworks, and increasing demand for efficient supply chain solutions. Companies are focusing on risk assessment and management strategies to enhance operational resilience, particularly in the face of global disruptions.

The competitive landscape is robust, with key players like FedEx, UPS, and DHL dominating the market. The U.S. is the primary contributor, supported by a strong infrastructure and logistics network. The presence of major firms fosters innovation and collaboration, ensuring that North America remains at the forefront of logistics services, particularly in risk mitigation strategies.

Europe : Regulatory Frameworks in Logistics

Europe's Risk Mitigation in Logistics Services Market is valued at 2.25, reflecting a growing emphasis on regulatory compliance and sustainability. The region is witnessing increased demand for risk management solutions due to complex supply chains and geopolitical uncertainties. Regulatory bodies are pushing for enhanced safety standards and environmental considerations, driving innovation in logistics practices.

Leading countries such as Germany, France, and the UK are pivotal in shaping the market landscape. Major players like DHL and DB Schenker are investing in technology to improve risk assessment capabilities. The competitive environment is characterized by collaborations and partnerships aimed at enhancing service offerings and ensuring compliance with evolving regulations.

Asia-Pacific : Emerging Market Dynamics

The Asia-Pacific region, with a market size of 1.75, is rapidly evolving in the Risk Mitigation in Logistics Services Market. The growth is fueled by increasing trade activities, urbanization, and the rise of e-commerce. Governments are implementing policies to enhance logistics infrastructure, which is crucial for mitigating risks associated with supply chain disruptions and ensuring timely deliveries.

Countries like China, Japan, and India are leading the charge, with significant investments in logistics technology and infrastructure. Key players such as Nippon Express and Kuehne + Nagel are expanding their operations to cater to the growing demand. The competitive landscape is marked by innovation and a focus on sustainability, positioning the region as a vital player in global logistics services.

Middle East and Africa : Developing Logistics Infrastructure

The Middle East and Africa region, with a market size of 0.75, presents unique challenges and opportunities in the Risk Mitigation in Logistics Services Market. The growth is driven by increasing investments in logistics infrastructure and a focus on enhancing supply chain resilience. Governments are recognizing the importance of logistics in economic development, leading to supportive policies and initiatives aimed at improving service delivery.

Countries like the UAE and South Africa are at the forefront, with key players such as DB Schenker and XPO Logistics expanding their presence. The competitive landscape is evolving, with a focus on technology adoption and partnerships to address regional challenges. As the market matures, there is significant potential for growth in risk mitigation strategies tailored to local needs.