North America : Market Leader in Legal Services

North America continues to lead the Risk and Compliance Legal Services Market, holding a significant market share of 18.75 in 2024. The region's growth is driven by stringent regulatory frameworks, increasing demand for compliance solutions, and a robust legal infrastructure. Companies are investing heavily in technology to enhance service delivery and meet evolving client needs, further propelling market expansion.

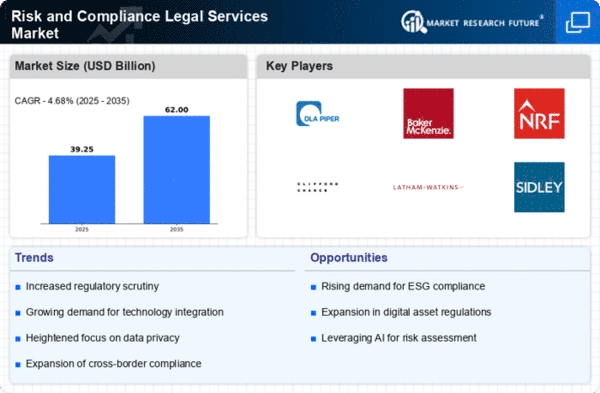

The competitive landscape is characterized by major players such as Latham & Watkins, Sidley Austin, and Hogan Lovells, which dominate the market. The U.S. remains the largest contributor, with a strong focus on financial services and healthcare sectors. The presence of top-tier law firms ensures a high level of expertise and innovation, making North America a hub for risk and compliance legal services.

Europe : Evolving Regulatory Landscape

Europe's Risk and Compliance Legal Services Market is valued at 10.5, reflecting a growing need for legal expertise in navigating complex regulations. The region is experiencing heightened demand for compliance services due to evolving EU regulations and increased scrutiny on corporate governance. This regulatory environment is a key driver for growth, as businesses seek to mitigate risks and ensure compliance with stringent laws.

Leading countries such as the UK, Germany, and France are at the forefront of this market, with firms like DLA Piper and Baker McKenzie playing pivotal roles. The competitive landscape is marked by a mix of established firms and emerging players, all striving to adapt to the dynamic regulatory framework. As companies invest in compliance strategies, the demand for specialized legal services is expected to rise significantly.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region, with a market size of 6.0, is witnessing rapid growth in Risk and Compliance Legal Services. This growth is fueled by increasing foreign investments, expanding economies, and a rising awareness of compliance requirements among businesses. Governments are also implementing stricter regulations, which is driving demand for legal services that can navigate these complexities effectively.

Countries like China, India, and Japan are leading the charge, with a growing number of law firms entering the market to cater to diverse client needs. The competitive landscape is evolving, with both local and international firms vying for market share. Key players are focusing on building expertise in sectors such as technology and finance, which are critical for compliance in this dynamic region.

Middle East and Africa : Developing Legal Frameworks

The Middle East and Africa region, valued at 2.25, is gradually developing its Risk and Compliance Legal Services Market. The growth is driven by increasing foreign investments and the need for businesses to comply with local regulations. Governments are enhancing their legal frameworks, which is creating opportunities for legal service providers to offer compliance solutions tailored to regional needs.

Countries like the UAE and South Africa are emerging as key players in this market, with a growing number of law firms establishing a presence. The competitive landscape is characterized by a mix of local firms and international players, all aiming to capture the growing demand for compliance services. As businesses recognize the importance of legal compliance, the market is expected to expand significantly in the coming years.