Rigid Plastic Packaging Size

Rigid Plastic Packaging Market Growth Projections and Opportunities

The size of the Rigid Plastic Packaging Market is dynamic and influenced by diverse factors governing the growth and development of this industry. Increasing demand for sturdy and lightweight packaging across various industries constitutes one of the main drivers propelling this market. As a result, rigid plastic packaging offers a flexible, cost-effective packaging option that serves sectors such as food, beverages, health care among others.

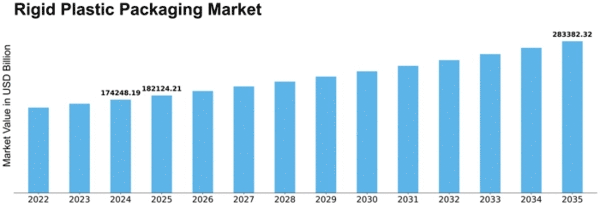

The size of Rigid Plastic Packaging Market was valued at approximately USD 132548.5 million in 2021. Thus, the rigid plastic packaging industry is expected to grow from USD 139838.66 million in 2022 to USD 203420.39 million by 2030 with a CAGR of 5.50%.

Additionally, environmental considerations and sustainability have become crucial aspects leading to adoption of rigid plastic packaging made from recyclable materials recently. Moreover, however much the sector has developed environmentally friendly alternatives that could minimize environmental harm related with plastics encasements due to consumer demands and regulatory concerns on sustainability.The shift towards more sustainable approaches has resulted in new possibilities for innovation in materials and processes within rigid plastic packaging market.

Global economic trends also play a pivotal role in shaping market dynamics. Changes in economies either way can directly influence spending patterns by consumers affecting their need for packed products.When economies are booming ,consumption tends to increase thus there is increased demand for rigid plastic packages.In contrast ,economic downtimes may temporarily slow down demand.

Technological advancements are another significant factor influencing the rigid plastic packaging market because they lead to continuous transformations within its structures.All these developments enhance both quality and accessibility of package which expand its scope of application thereby boosting its sales as well as production volumes (MarketResearch).These technological advancements keep improving manufacturing processes such as injection molding and blow molding technologies thereby increasing efficiency while reducing production costs.Currently,new global brands coming into existence are targeting younger generations who are interested in buying things online.Research and development efforts must be continuous to have an advantage over other companies in this market while keeping up with trends (Ibid).

Regulatory factors also exert a substantial influence on the rigid plastic packaging market. Governments and international bodies are implementing regulations that address the issue of plastic waste and environmental impact associated with its usage. They have also introduced policies promoting use of recyclable materials and responsible disposal practices. Manufacturers who comply with them are bound to shape their product developments as well as market strategies.

Consumer preferences and changing lifestyles are additional pivotal factors affecting the rigid plastic packaging market. The increase in demand for convenience accompanied by the rise of the E-commerce has resulted in growing single-use packaging options.Rigid plastics being light weight and strong meets this need for consumers especially those who buy products through online marketing.

Furthermore, how competitive it is determines much about where this industry will go next.Thus, through carrying out constant researches they get ahead bringing new types of packagings which are original.They can then expand or merge thus increasing innovation leading to a consolidation of position among the major brands alongside collaborations between local firms playing significant roles.

Leave a Comment