Rise of E-commerce Integration

The rise of e-commerce integration is a significant driver in the Retail Point Of Sale Market. As online shopping continues to gain traction, retailers are increasingly seeking to unify their online and offline sales channels. This integration allows for a cohesive customer experience, enabling consumers to shop seamlessly across platforms. Recent data indicates that e-commerce sales are projected to account for over 20% of total retail sales by 2025. Retailers are investing in POS systems that can synchronize inventory and sales data across both physical and digital storefronts. This trend not only enhances operational efficiency but also provides valuable insights into consumer behavior, which can inform marketing strategies. Consequently, the Retail Point Of Sale Market is likely to see a surge in demand for integrated solutions that support omnichannel retailing.

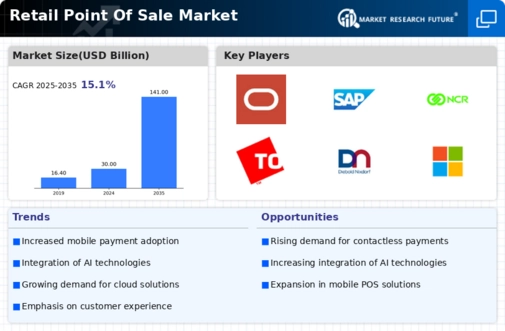

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into the Retail Point Of Sale Market is transforming how transactions are processed and customer interactions are managed. AI technologies, such as machine learning and natural language processing, enable retailers to analyze consumer behavior and preferences more effectively. This leads to personalized shopping experiences, which can enhance customer satisfaction and loyalty. According to recent data, the AI segment within the retail sector is projected to grow at a compound annual growth rate of over 30% in the coming years. Retailers are increasingly adopting AI-driven solutions to optimize inventory management and streamline operations, thereby reducing costs and improving efficiency. As a result, the Retail Point Of Sale Market is likely to witness a significant shift towards AI-enhanced systems that provide real-time insights and analytics.

Emphasis on Enhanced Customer Experience

The emphasis on enhanced customer experience is increasingly shaping the Retail Point Of Sale Market. Retailers are recognizing that providing a seamless and enjoyable shopping experience is crucial for retaining customers and driving sales. This has led to the implementation of advanced POS systems that facilitate faster checkouts, personalized promotions, and loyalty programs. Data suggests that businesses that prioritize customer experience can achieve revenue growth rates of 4 to 8% higher than their competitors. As retailers strive to differentiate themselves in a competitive landscape, the focus on customer experience is likely to drive innovation within the Retail Point Of Sale Market, prompting the development of more sophisticated and user-friendly POS solutions.

Growing Demand for Mobile Payment Solutions

The growing demand for mobile payment solutions is a key driver in the Retail Point Of Sale Market. Consumers are increasingly favoring the convenience of mobile wallets and payment apps, which allow for quick and secure transactions. Recent statistics indicate that mobile payment transactions are expected to surpass 1 trillion dollars by the end of 2025, reflecting a substantial shift in consumer preferences. Retailers are responding by integrating mobile payment options into their point of sale systems, thereby enhancing the overall shopping experience. This trend not only caters to tech-savvy consumers but also helps retailers reduce transaction times and improve operational efficiency. As mobile payment adoption continues to rise, the Retail Point Of Sale Market is likely to evolve, with more businesses investing in mobile-compatible POS systems.

Regulatory Compliance and Security Enhancements

Regulatory compliance and security enhancements are critical drivers in the Retail Point Of Sale Market. With the increasing prevalence of data breaches and cyber threats, retailers are compelled to adopt robust security measures to protect customer information. Compliance with regulations such as the Payment Card Industry Data Security Standard (PCI DSS) is essential for maintaining consumer trust. Recent reports indicate that the cost of data breaches can exceed millions of dollars, prompting retailers to invest in secure POS systems that incorporate advanced encryption and fraud detection technologies. As the regulatory landscape continues to evolve, the Retail Point Of Sale Market is likely to experience heightened demand for solutions that prioritize security and compliance, ensuring that retailers can safeguard their operations and customer data.