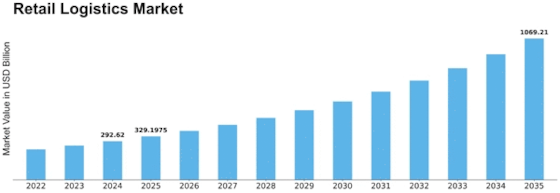

Retail Logistics Size

Retail Logistics Market Growth Projections and Opportunities

The dynamics of the retail logistics market are influenced by a multitude of factors, each playing a significant role in shaping its landscape. One primary driver is consumer demand, which serves as the foundation upon which all other market factors rest. As consumer preferences evolve, so too must the retail logistics sector, adapting to meet changing demands for faster delivery, greater product variety, and seamless omnichannel experiences. Additionally, economic conditions exert considerable influence, with factors such as GDP growth, inflation rates, and employment levels impacting consumer spending habits and, consequently, the volume and nature of goods transported through the logistics network.

Technological advancements represent another pivotal factor in the retail logistics market. Innovations such as automation, artificial intelligence, and real-time tracking systems enhance efficiency, reduce costs, and improve customer service. Integration of these technologies into logistics operations has become essential for companies seeking to remain competitive in an increasingly digital marketplace. Moreover, sustainability considerations have emerged as a critical concern for both retailers and consumers alike. Environmental regulations, carbon emissions targets, and consumer preferences for eco-friendly products influence decisions regarding transportation modes, packaging materials, and supply chain practices.

Globalization has profoundly transformed the retail logistics landscape, facilitating the movement of goods across borders and opening new markets for retailers. However, geopolitical factors such as trade tensions, tariffs, and regulatory changes can disrupt supply chains and introduce uncertainty into the market. Furthermore, the rise of e-commerce has revolutionized retail logistics, fueling demand for last-mile delivery services and fulfillment centers strategically located near urban centers. As online shopping continues to grow, retailers must navigate the complexities of managing omnichannel inventories and meeting customer expectations for fast, reliable delivery.

Infrastructure investments play a crucial role in supporting the efficient movement of goods within the retail logistics network. Adequate transportation infrastructure, including roads, ports, and distribution centers, is essential for ensuring timely delivery of products to consumers. Moreover, investments in technology-enabled logistics hubs and warehousing facilities enhance operational efficiency and enable retailers to meet evolving customer demands effectively. However, infrastructure constraints, such as congestion and capacity limitations, can pose challenges for logistics providers, requiring innovative solutions and collaboration among stakeholders.

Regulatory policies also exert a significant influence on the retail logistics market, shaping industry practices and governing aspects such as labor standards, safety regulations, and taxation. Compliance with regulatory requirements is essential for retailers and logistics companies to avoid legal liabilities and maintain the trust of consumers and stakeholders. Moreover, changes in regulations, such as those related to data privacy or import/export procedures, can impact supply chain operations and necessitate adjustments in logistics strategies.

Lastly, competitive dynamics within the retail sector itself contribute to the complexities of the logistics market. Retailers compete not only on the basis of product offerings and pricing but also on the efficiency and reliability of their logistics operations. Strategic partnerships, mergers, and acquisitions are common tactics employed by retailers to strengthen their supply chain capabilities and gain a competitive edge. Additionally, the rise of third-party logistics providers offers retailers opportunities to outsource non-core logistics functions and access specialized expertise.

Leave a Comment