Retail Bags Size

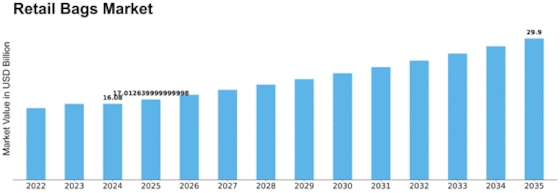

Retail Bags Market Growth Projections and Opportunities

Several factors influence the Retail Bags market and its development. One of the most significant factors in this market is The Retail Landscape on a global level with retail bags going hand-in hand to growth for that sector. With consumer shopping habits evolving, influenced by e-commerce along with issues such as sustainability concerns and convenience; it is the retail bags market’s responsibility to adjust accordingly. The preference of retailers and their clients determine the type, shape, or style whether they are papers ones or plastics reusable others even eco-friendly as it has been stated. One of the most important factors that plays a significant role in this market include price sensitivity where both retailers and consumers considered bags as an integral part of their cost structure. This element frequently determines the choice between various kinds of bags and encourages retailers to find cost-effective yet environmentally responsible alternatives. Manufacturers and suppliers engage in price competition, which is a persistent feature of the market that makes firms provide low-cost services without sacrificing quality. Environmental concerns are becoming a more important factor in the Retail Bags market. With the increasing awareness of environmental issues, there are more demands for environmentally friendly and viable bag options. Retailers should find ways in which they can eliminate single-use plastics and provide a reusable, recycle or biodegradable alternative for its customers. The market responds to regulations and consumer demand by moving towards more environmentally friendly measures, which is a win for companies that adopt sustainable practices. The retail bags market is a design and branding driven industry. Retailers do not only use bags as a carrier for purchased items, but also develops them to be an effective branding tool. They help in marketing the products because customized bags bearing logos, colors and design that are consistent with a retailer’s brand image add to it. Design is a very essential factor for the market because retail bags’ aesthetics play their role in consumer perception and brand recall. The Retail Bags market is also affected by technological advances, especially in the production and tailoring of bags. The rich variety of bags surfaces results from the development of advanced printing technologies, innovative materials as well as manufacturing techniques. Automating the production process has enabled manufacturers to meet demand for bulk orders with quality and cost-effectiveness.

Leave a Comment