Rising Energy Costs

Rising energy costs are a significant driver of the Residential Solar EPC Market. As traditional energy prices continue to escalate, homeowners are increasingly seeking alternative energy solutions to mitigate their energy expenses. The cost of electricity from conventional sources has shown a consistent upward trend, prompting consumers to explore solar energy as a viable option. In many regions, the levelized cost of solar energy has become competitive with or even lower than that of fossil fuels. This shift in economic dynamics encourages more homeowners to invest in solar installations, thereby propelling the growth of the Residential Solar EPC Market. The potential for long-term savings on energy bills further incentivizes this transition.

Government Incentives and Subsidies

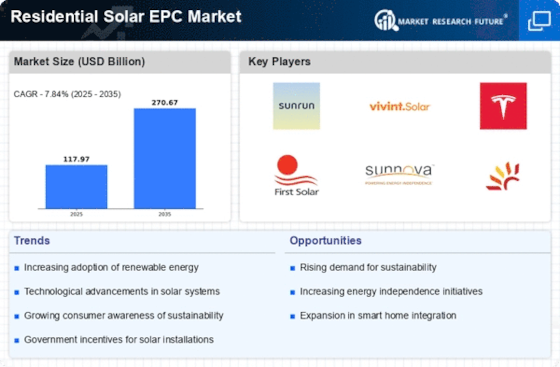

The presence of government incentives and subsidies plays a crucial role in the Residential Solar EPC Market. Various countries have implemented policies to promote renewable energy adoption, including tax credits, rebates, and grants for solar installations. For instance, in the United States, the federal solar tax credit allows homeowners to deduct a significant percentage of the cost of solar systems from their federal taxes. This financial support not only reduces the upfront costs for consumers but also stimulates demand for solar installations. As a result, the Residential Solar EPC Market experiences accelerated growth, with projections indicating that the market could reach a valuation of several billion dollars in the coming years, driven by these favorable policies.

Environmental Concerns and Sustainability

Environmental concerns and the push for sustainability are driving the Residential Solar EPC Market. As awareness of climate change and environmental degradation grows, consumers are increasingly motivated to adopt renewable energy solutions. Solar energy is viewed as a clean and sustainable alternative to fossil fuels, which contributes to greenhouse gas emissions. The desire to reduce one's carbon footprint and contribute to a more sustainable future is influencing purchasing decisions. This trend is reflected in the increasing number of residential solar installations, as homeowners recognize the environmental benefits of solar energy. Consequently, the Residential Solar EPC Market is likely to see continued growth as more individuals prioritize eco-friendly energy solutions.

Technological Advancements in Solar Energy

Technological advancements in solar energy systems are transforming the Residential Solar EPC Market. Innovations such as improved photovoltaic cell efficiency, energy storage solutions, and smart grid technologies enhance the performance and reliability of solar installations. For example, the development of bifacial solar panels, which capture sunlight on both sides, has increased energy generation potential. Additionally, the integration of battery storage systems allows homeowners to store excess energy for later use, further increasing the appeal of solar solutions. These advancements not only improve the return on investment for consumers but also contribute to the overall growth of the Residential Solar EPC Market, as more homeowners seek to adopt these cutting-edge technologies.

Increased Availability of Financing Options

The increased availability of financing options is a key driver in the Residential Solar EPC Market. Various financial products, such as solar loans, leases, and power purchase agreements (PPAs), have emerged to make solar installations more accessible to homeowners. These financing solutions allow consumers to install solar systems with little to no upfront costs, making it easier for them to transition to solar energy. As a result, the market has witnessed a surge in residential solar projects, with many homeowners opting for financing arrangements that suit their financial situations. This trend not only enhances the affordability of solar energy but also contributes to the overall expansion of the Residential Solar EPC Market, as more individuals are empowered to invest in renewable energy.