Aging Population

The aging population is a significant driver of the Repositioning and Offloading Device Market. As the global demographic shifts towards an older population, the prevalence of chronic conditions such as diabetes and mobility impairments increases. This demographic trend necessitates the use of repositioning and offloading devices to prevent complications like pressure ulcers, which are common among elderly patients. According to recent statistics, the number of individuals aged 65 and older is expected to double by 2050, creating a substantial demand for these devices. Healthcare providers are increasingly recognizing the importance of investing in effective offloading solutions to enhance patient care and reduce hospital readmission rates. Consequently, the market is likely to expand as healthcare systems adapt to the needs of an aging population, driving innovation and product development in the Repositioning and Offloading Device Market.

Regulatory Compliance

Regulatory compliance plays a pivotal role in shaping the Repositioning and Offloading Device Market. Stringent regulations imposed by health authorities ensure that devices meet safety and efficacy standards, thereby fostering consumer trust. Manufacturers are increasingly investing in research and development to comply with these regulations, which can be both a challenge and an opportunity. The market is witnessing a rise in certifications and approvals for innovative products, which can enhance marketability. For example, devices that meet ISO standards are often preferred by healthcare providers, leading to increased sales. As regulations evolve, companies that adapt quickly are likely to gain a competitive edge. This compliance-driven approach not only ensures patient safety but also stimulates market growth, as compliant products are more readily adopted in clinical settings.

Technological Advancements

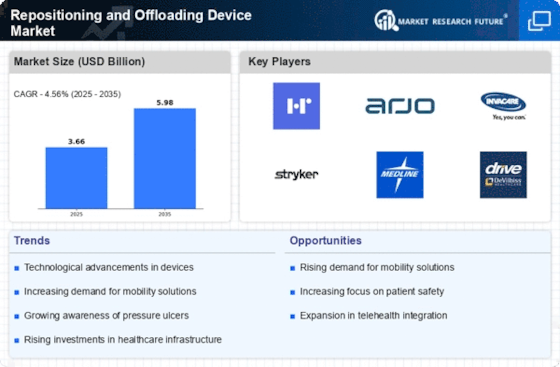

The Repositioning and Offloading Device Market is experiencing a surge in demand due to rapid technological advancements. Innovations in materials and design are leading to the development of more effective and comfortable devices. For instance, the integration of smart technology into offloading devices allows for real-time monitoring of pressure distribution, which is crucial for preventing pressure ulcers. The market is projected to grow at a compound annual growth rate of approximately 6.5% over the next five years, driven by these advancements. Furthermore, the introduction of 3D printing technology is enabling customized solutions that cater to individual patient needs, enhancing the overall efficacy of repositioning devices. This trend indicates a shift towards more personalized healthcare solutions, which is likely to reshape the landscape of the Repositioning and Offloading Device Market.

Rising Healthcare Expenditure

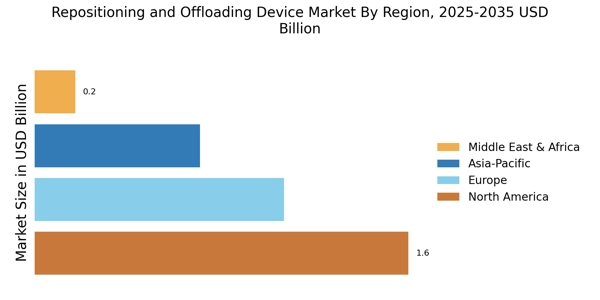

Rising healthcare expenditure is another critical driver influencing the Repositioning and Offloading Device Market. As countries allocate more resources to healthcare, there is a growing emphasis on preventive care and patient safety. Increased funding allows healthcare facilities to invest in advanced repositioning and offloading devices, which are essential for managing patient care effectively. Reports indicate that healthcare spending is projected to rise by 5% annually, leading to greater adoption of innovative medical devices. This trend is particularly evident in developed regions, where hospitals are prioritizing the acquisition of high-quality offloading solutions to improve patient outcomes. The focus on cost-effective healthcare solutions further propels the demand for devices that can prevent complications and reduce overall treatment costs, thereby enhancing the growth potential of the Repositioning and Offloading Device Market.

Increased Awareness and Education

Increased awareness and education regarding pressure ulcer prevention are driving the Repositioning and Offloading Device Market. Healthcare professionals and caregivers are becoming more informed about the risks associated with immobility and the importance of using appropriate devices. Educational initiatives and training programs are being implemented to promote best practices in patient care, which includes the use of repositioning and offloading devices. This heightened awareness is leading to a greater demand for these products, as healthcare providers seek to implement effective strategies to mitigate risks. Furthermore, patient education on the importance of mobility and skin care is also contributing to market growth. As awareness continues to rise, the Repositioning and Offloading Device Market is likely to see an increase in product adoption, ultimately improving patient outcomes and quality of care.