North America : Leading Market Innovators

North America is poised to maintain its leadership in the Renewable Energy Equipment Maintenance and MRO Services Market, holding a significant market share of 10.0 in 2024. The region's growth is driven by increasing investments in renewable energy infrastructure, favorable government policies, and a strong push towards sustainability. Regulatory incentives and tax credits are further catalyzing demand for maintenance services, ensuring operational efficiency and longevity of renewable energy assets.

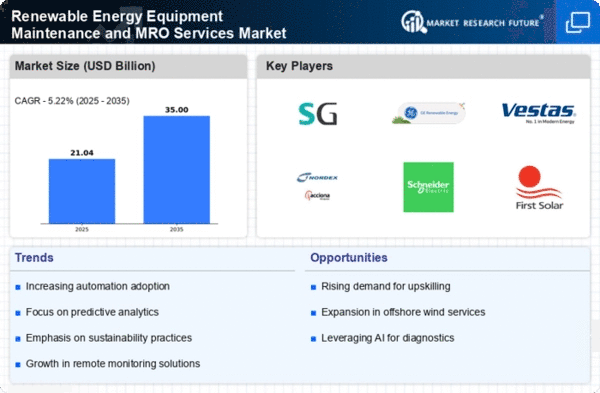

The competitive landscape in North America is robust, featuring key players such as GE Renewable Energy, Siemens Gamesa, and First Solar. The U.S. leads the market, supported by substantial investments in wind and solar energy. Canada is also emerging as a significant player, focusing on solar energy solutions. The presence of established companies and innovative startups fosters a dynamic environment, enhancing service offerings and technological advancements.

Europe : Sustainable Energy Transition

Europe is experiencing a transformative shift in the Renewable Energy Equipment Maintenance and MRO Services Market, with a market size of 6.0 in 2024. The region's commitment to achieving net-zero emissions by 2050 is a key driver, supported by stringent regulations and ambitious renewable energy targets. The European Green Deal and national policies are fostering investments in maintenance services, ensuring the reliability and efficiency of renewable energy systems.

Leading countries such as Germany, Denmark, and Spain are at the forefront of this transition, with significant investments in wind and solar energy. Major players like Vestas Wind Systems and Nordex SE are enhancing their service capabilities to meet growing demand. The competitive landscape is characterized by innovation and collaboration, as companies seek to optimize maintenance strategies and reduce operational costs. The European market is set to expand further as sustainability becomes a priority across sectors.

Asia-Pacific : Emerging Market Potential

Asia-Pacific is emerging as a significant player in the Renewable Energy Equipment Maintenance and MRO Services Market, with a market size of 3.5 in 2024. The region's rapid industrialization and urbanization are driving demand for renewable energy solutions, supported by government initiatives promoting clean energy. Countries like China and India are investing heavily in solar and wind energy, creating a favorable environment for maintenance services to thrive.

China leads the market, being the largest producer of renewable energy equipment, while India is rapidly expanding its renewable capacity. The competitive landscape includes key players such as Enphase Energy and SMA Solar Technology, which are focusing on innovative maintenance solutions. As the region continues to prioritize sustainability, the demand for MRO services is expected to grow, driven by the need for efficient and reliable energy systems.

Middle East and Africa : Resource-Rich Opportunities

The Middle East and Africa region is gradually developing its Renewable Energy Equipment Maintenance and MRO Services Market, with a market size of 0.5 in 2024. The region is rich in natural resources and is increasingly recognizing the importance of diversifying energy sources. Government initiatives aimed at promoting renewable energy, particularly solar power, are driving demand for maintenance services, as countries seek to enhance energy security and sustainability.

Leading countries such as the UAE and South Africa are making significant strides in renewable energy projects. The competitive landscape is evolving, with local and international players entering the market to provide MRO services. As investments in renewable energy infrastructure grow, the demand for efficient maintenance solutions will become critical to ensure the longevity and performance of renewable energy assets.