Cost Efficiency

Cost efficiency is a significant driver influencing the Remote Testing Inspection and Certification TIC Market. Organizations are increasingly seeking ways to reduce operational costs while maintaining high-quality standards. Remote inspections offer a viable solution by minimizing travel expenses and reducing the time required for on-site evaluations. By leveraging digital tools and technologies, companies can conduct inspections remotely, which not only cuts costs but also enhances productivity. A recent analysis revealed that businesses utilizing remote TIC services can save up to 30% on inspection-related expenses. This financial incentive is compelling many organizations to adopt remote testing and certification solutions, thereby contributing to the growth of the Remote Testing Inspection and Certification TIC Market. As cost pressures continue to mount, the demand for these services is likely to rise.

Regulatory Compliance

Regulatory compliance remains a pivotal driver in the Remote Testing Inspection and Certification TIC Market. As industries face stringent regulations and standards, the need for reliable testing and certification services becomes paramount. Companies are compelled to ensure that their products meet safety, quality, and environmental standards, which often necessitates third-party inspections. The rise in regulatory frameworks across various sectors, including pharmaceuticals, food safety, and environmental protection, has led to an increased reliance on remote TIC services. Recent statistics indicate that the demand for compliance-related inspections has risen by approximately 15% in the past year, underscoring the critical role of remote TIC providers in helping businesses navigate complex regulatory landscapes. This trend is expected to continue, further propelling the growth of the Remote Testing Inspection and Certification TIC Market.

Technological Advancements

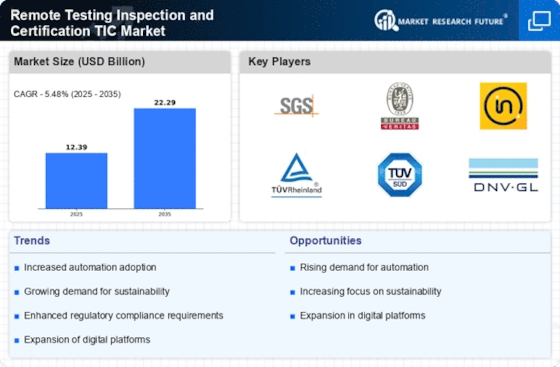

The Remote Testing Inspection and Certification TIC Market is experiencing a surge in demand due to rapid technological advancements. Innovations such as artificial intelligence, machine learning, and the Internet of Things are transforming traditional inspection methods. These technologies enhance accuracy, reduce human error, and streamline processes, making remote inspections more efficient. For instance, the integration of drones and robotics in inspections allows for real-time data collection and analysis, which is crucial for industries like construction and manufacturing. According to recent data, the market for remote TIC services is projected to grow at a compound annual growth rate of 10% over the next five years, driven by these technological innovations. As companies increasingly adopt these advanced solutions, the Remote Testing Inspection and Certification TIC Market is likely to expand significantly.

Market Expansion in Emerging Economies

The Remote Testing Inspection and Certification TIC Market is witnessing notable expansion in emerging economies. As these regions develop their industrial sectors, the demand for testing, inspection, and certification services is increasing. Countries in Asia, Africa, and Latin America are investing in infrastructure and manufacturing capabilities, which necessitate robust TIC services to ensure product quality and safety. Recent reports indicate that the market in these regions is expected to grow by over 20% in the next few years, driven by rising industrialization and regulatory requirements. This trend presents significant opportunities for TIC providers to establish a presence in these markets. As businesses in emerging economies seek to enhance their competitiveness, the Remote Testing Inspection and Certification TIC Market is poised for substantial growth.

Consumer Awareness and Demand for Quality

Consumer awareness regarding product quality and safety is a crucial driver for the Remote Testing Inspection and Certification TIC Market. As consumers become more informed and discerning, they increasingly demand transparency and assurance regarding the products they purchase. This heightened awareness compels manufacturers to prioritize quality control and compliance with safety standards. Consequently, companies are turning to remote TIC services to validate their products and build consumer trust. Recent surveys indicate that approximately 70% of consumers are willing to pay a premium for certified products, highlighting the importance of TIC services in meeting consumer expectations. This trend is likely to continue, further fueling the growth of the Remote Testing Inspection and Certification TIC Market as businesses strive to meet the evolving demands of their customers.