Refurbished Electronics Size

Refurbished Electronics Market Growth Projections and Opportunities

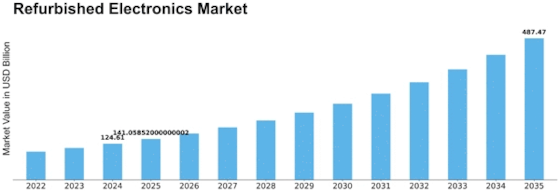

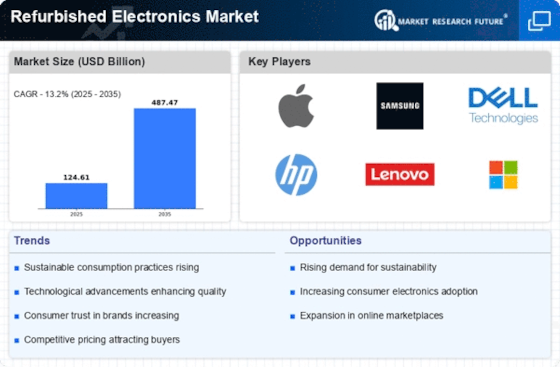

The refurbished electronics market is a dynamic and rapidly growing sector that is significantly influenced by various market factors. One of the key drivers of this market is the increasing consumer demand for cost-effective and sustainable electronic devices. As technology advances at a rapid pace, consumers often seek the latest gadgets, leaving behind slightly older yet perfectly functional devices. Refurbished electronics, which are pre-owned devices that have been repaired and restored to a like-new condition, provide a more affordable alternative for budget-conscious consumers.

Another crucial factor shaping the refurbished electronics market is environmental awareness. With a growing emphasis on sustainability and reducing electronic waste, consumers are increasingly opting for refurbished devices as a way to minimize their environmental impact. Manufacturers and retailers in the refurbished electronics market often highlight the eco-friendly aspects of their products, contributing to a positive perception of refurbished devices among environmentally conscious consumers.

The economic factor also plays a significant role in the growth of the refurbished electronics market. In times of economic uncertainty, consumers tend to be more price-sensitive and look for cost-effective alternatives. Refurbished electronics offer a compelling option for those who want reliable devices without the hefty price tag associated with brand-new products. The affordability of refurbished devices makes them an attractive choice for individuals and businesses alike, contributing to the overall expansion of the market.

Moreover, the technological advancements in the refurbishment process itself contribute to the market's growth. Refurbished electronics are no longer perceived as inferior or less reliable compared to their new counterparts. Improved refurbishment techniques, stringent quality control measures, and warranties provided by manufacturers and retailers have bolstered consumer confidence in refurbished products. As a result, buyers are more willing to consider refurbished electronics as a viable and trustworthy option, further fueling market growth.

Government regulations and policies also influence the refurbished electronics market. Some regions may have strict regulations regarding the disposal of electronic waste, pushing consumers and businesses to explore sustainable alternatives such as refurbishment. Incentives and initiatives by governments to promote the circular economy and reduce electronic waste contribute to the positive momentum of the refurbished electronics market.

Additionally, the availability of a wide range of refurbished products across different categories and brands contributes to the market's appeal. From smartphones and laptops to home appliances, consumers have a plethora of options to choose from when opting for refurbished electronics. This diverse product offering caters to various consumer preferences and needs, expanding the market's reach and appeal.

However, challenges such as consumer skepticism and concerns about the reliability of refurbished products still exist. Education and awareness campaigns regarding the quality and benefits of refurbished electronics are essential to overcoming these challenges and fostering greater acceptance among consumers.

Leave a Comment