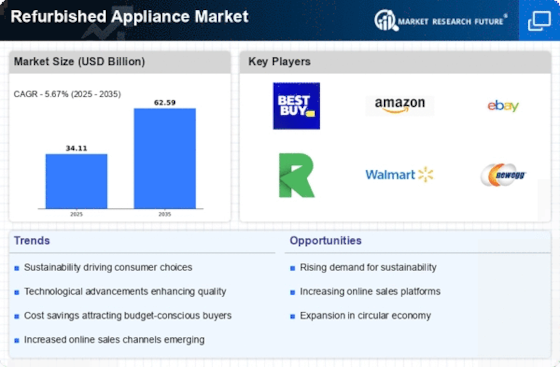

The Refurbished Appliance Market is currently characterized by a dynamic competitive landscape, driven by increasing consumer demand for sustainable and cost-effective solutions. Key players such as Best Buy (US), Amazon (US), and Back Market (FR) are strategically positioning themselves to capitalize on this trend. Best Buy (US) has focused on enhancing its online presence and expanding its refurbished product range, while Amazon (US) leverages its vast logistics network to offer competitive pricing and rapid delivery. Back Market (FR), a notable player in the European market, emphasizes quality assurance and customer service, which differentiates it from other competitors. Collectively, these strategies contribute to a competitive environment that is increasingly focused on customer experience and sustainability.

In terms of business tactics, companies are localizing manufacturing and optimizing supply chains to enhance efficiency and reduce costs. The market appears moderately fragmented, with several players vying for market share. However, the influence of major companies is significant, as they set standards for quality and service that smaller players often strive to meet. This competitive structure fosters innovation and encourages new entrants to adopt best practices in refurbishment and customer engagement.

In September 2025, Best Buy (US) announced a partnership with a leading technology firm to develop an AI-driven platform aimed at improving the refurbishment process. This strategic move is likely to enhance operational efficiency and product quality, positioning Best Buy (US) as a leader in technological integration within the refurbished appliance sector. The emphasis on AI suggests a commitment to innovation that could redefine customer interactions and streamline inventory management.

In August 2025, Amazon (US) launched a new initiative to expand its refurbished appliance offerings, focusing on energy-efficient models. This initiative aligns with growing consumer preferences for environmentally friendly products and positions Amazon (US) to capture a larger share of the market. The strategic importance of this move lies in its potential to attract eco-conscious consumers, thereby enhancing brand loyalty and market penetration.

In July 2025, Back Market (FR) introduced a comprehensive warranty program for its refurbished appliances, which aims to build consumer trust and mitigate concerns regarding product reliability. This initiative is particularly significant as it addresses a common barrier to purchasing refurbished goods. By enhancing customer confidence, Back Market (FR) is likely to strengthen its market position and encourage more consumers to consider refurbished options.

As of October 2025, the Refurbished Appliance Market is witnessing trends such as digitalization, sustainability, and the integration of AI technologies. Strategic alliances are increasingly shaping the competitive landscape, as companies collaborate to enhance their service offerings and operational capabilities. Looking ahead, competitive differentiation is expected to evolve from traditional price-based competition to a focus on innovation, technology, and supply chain reliability. This shift underscores the importance of adapting to consumer preferences and leveraging technological advancements to maintain a competitive edge.