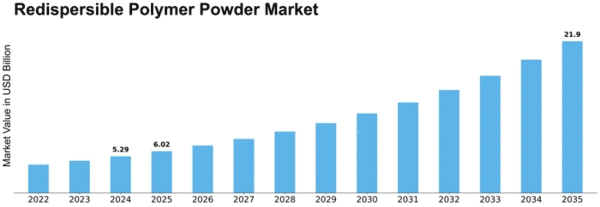

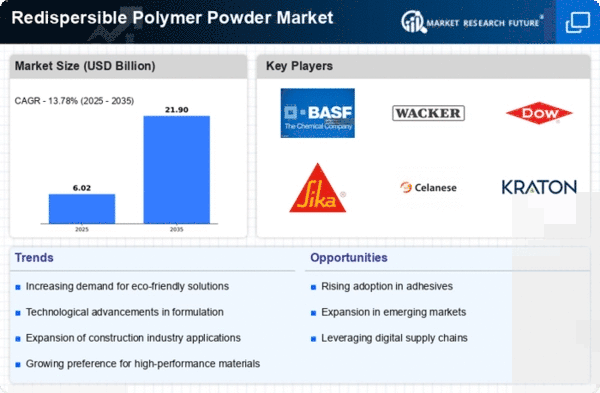

Market Growth Projections

The Global Redispersible Polymer Powder Market Industry is projected to experience robust growth in the coming years. With a market value anticipated to reach 5.29 USD Billion in 2024 and further expand to 21.9 USD Billion by 2035, the industry is poised for a compound annual growth rate (CAGR) of 13.78% from 2025 to 2035. This growth is indicative of the increasing applications of redispersible polymer powders across various sectors, including construction, adhesives, and coatings. The positive market outlook reflects the ongoing innovations and rising demand for high-performance materials, positioning the Global Redispersible Polymer Powder Market Industry for sustained expansion.

Expansion of Emerging Markets

Emerging markets play a crucial role in the growth of the Global Redispersible Polymer Powder Market Industry. Countries in Asia-Pacific, Latin America, and Africa are experiencing rapid industrialization and urbanization, leading to increased demand for construction materials. The expansion of these markets is fueled by rising disposable incomes and urban population growth, which drive the need for housing and infrastructure development. As these regions invest in construction projects, the demand for redispersible polymer powders is expected to rise, contributing to the overall growth trajectory of the market. This trend underscores the potential of emerging markets in shaping the future of the Global Redispersible Polymer Powder Market Industry.

Growing Demand in Construction Sector

The Global Redispersible Polymer Powder Market Industry experiences a surge in demand primarily driven by the construction sector. As urbanization accelerates, the need for high-performance construction materials increases. Redispersible polymer powders enhance the properties of cement-based products, improving adhesion, flexibility, and water resistance. This trend is particularly evident in regions with rapid infrastructure development, where the market is projected to reach 1.85 USD Billion in 2024. The construction industry's growth, fueled by government initiatives and investments in housing and commercial projects, significantly contributes to the expansion of the Global Redispersible Polymer Powder Market Industry.

Rising Adoption in Adhesives and Sealants

The Global Redispersible Polymer Powder Market Industry is witnessing a notable increase in the adoption of these powders in adhesives and sealants. The versatility of redispersible polymer powders allows for enhanced bonding strength and flexibility in various applications, making them a preferred choice for manufacturers. As industries focus on developing eco-friendly and high-performance adhesive solutions, the demand for redispersible polymer powders is expected to grow. This trend aligns with the projected market growth, with estimates indicating a rise to 3.42 USD Billion by 2035, reflecting a compound annual growth rate (CAGR) of 5.77% from 2025 to 2035.

Technological Advancements in Polymer Chemistry

Technological advancements in polymer chemistry significantly influence the Global Redispersible Polymer Powder Market Industry. Innovations in production techniques and formulations lead to the development of superior polymer powders with enhanced properties. These advancements allow for better performance in various applications, including construction, coatings, and adhesives. As manufacturers strive to meet evolving industry standards and consumer preferences, the continuous improvement of redispersible polymer powders becomes essential. This dynamic environment fosters growth and positions the market for substantial expansion, as companies leverage these innovations to capture a larger share of the Global Redispersible Polymer Powder Market Industry.

Increasing Focus on Sustainable Construction Practices

The Global Redispersible Polymer Powder Market Industry is increasingly shaped by the focus on sustainable construction practices. As environmental concerns rise, builders and manufacturers are seeking materials that minimize ecological impact. Redispersible polymer powders, which can enhance the performance of eco-friendly building materials, are gaining traction. This shift towards sustainability is not only driven by regulatory pressures but also by consumer demand for greener products. As a result, the market is likely to see significant growth opportunities, aligning with the broader trend of sustainable development in the construction sector, thereby reinforcing the Global Redispersible Polymer Powder Market Industry.

Leave a Comment