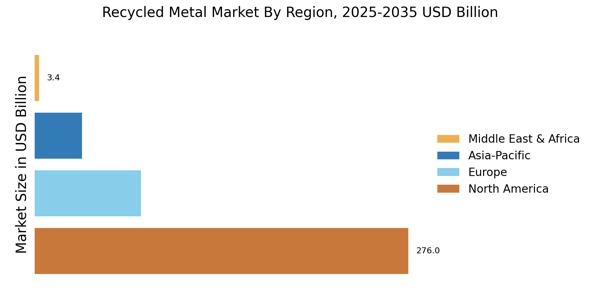

North America : Recycling Powerhouse

North America is witnessing robust growth in the recycled metal market, driven by increasing demand for sustainable materials and stringent environmental regulations. The U.S. holds the largest market share at approximately 70%, followed by Canada at around 15%. Regulatory initiatives aimed at reducing landfill waste and promoting recycling are significant catalysts for this growth. The region's focus on green technologies further enhances the demand for recycled metals. Initiatives to extract and reuse rare earth metals are observed to increase, which will eventually assist the rare earth metals recycling market.

The competitive landscape in North America is dominated by key players such as Nucor Corporation, Commercial Metals Company, and Steel Dynamics, Inc. These companies are leveraging advanced technologies to improve recycling processes and increase efficiency. The presence of a well-established infrastructure for metal recycling, along with government support, positions North America as a leader in global metal recycling market.

Europe : Sustainable Innovation Hub

Europe is emerging as a leader in the recycled metal market, driven by ambitious sustainability goals and regulatory frameworks. The European Union's Circular Economy Action Plan aims to increase recycling rates significantly, with the region holding a market share of approximately 20%. Germany and the UK are the largest markets, contributing to over 50% of the region's total recycled metal output. Regulatory measures, such as the Waste Framework Directive, are pivotal in promoting recycling initiatives across member states, which are also assisting the growth of the rare earth metals recycling market.

Leading countries like Germany, France, and the UK are home to major players such as European Metal Recycling and Sims Metal Management. The competitive landscape is characterized by innovation in recycling technologies and a strong emphasis on sustainability. The presence of advanced recycling facilities and a supportive regulatory environment fosters growth and attracts investments in the sector.

Asia-Pacific : Emerging Market Dynamics

The Asia-Pacific region is rapidly expanding in the recycled metal market, driven by industrial growth and increasing urbanization. China is the largest market, accounting for approximately 60% of the region's share, followed by India at around 15%. The demand for recycled metals is fueled by the need for sustainable manufacturing practices and government initiatives promoting recycling. Regulatory frameworks are evolving to support the growth of the recycling industry, enhancing market dynamics in the region. Newly found reserves of rare earth metals in India are likely to propel the growth of the rare earth metal recycling market. Reserves of metals like gold, silver, and many more are expected to govern the growth of the precious metal recycling market.

Key players in the Asia-Pacific market include major companies like Sims Metal Management and local firms that are increasingly adopting advanced recycling technologies. Countries such as Japan and South Korea are also making significant strides in recycling initiatives, contributing to a competitive landscape that is becoming more innovative. The region's focus on sustainability and resource efficiency is expected to drive further growth in the recycled metal market.

Middle East and Africa : Resource-Rich Frontier

The Middle East and Africa region is gradually developing its recycled metal market, driven by increasing industrialization and urbanization. The recycled metal market 2025 data suggested that the market share is relatively small, with the region holding about 5% of the global market. However, countries like South Africa and the UAE are emerging as key players, focusing on enhancing recycling capabilities and infrastructure. Government initiatives aimed at promoting recycling and reducing waste are beginning to take shape, providing a foundation for future growth.

In South Africa, the presence of companies like David J. Joseph Company and local firms is fostering competition in the recycling sector. The region's potential for growth is significant, as awareness of sustainability and resource management increases. As regulatory frameworks evolve, the Middle East and Africa are expected to attract investments in recycling technologies, paving the way for a more robust market in the coming years.