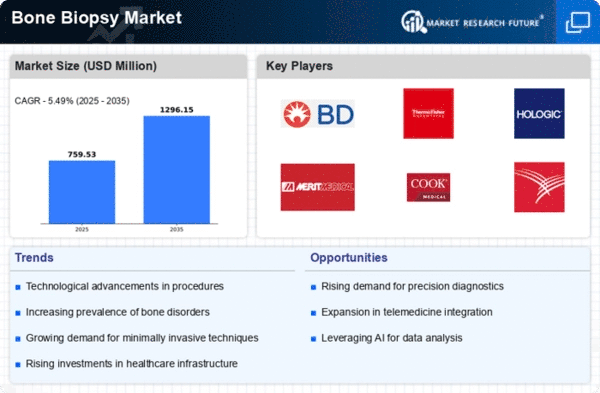

Market Growth Projections

The Global Bone Biopsy Market Industry is projected to experience substantial growth over the next decade. With an estimated market value of 0.72 USD Billion in 2024, it is expected to reach 1.3 USD Billion by 2035. This growth trajectory indicates a compound annual growth rate (CAGR) of 5.54% from 2025 to 2035. Factors contributing to this growth include increasing incidences of bone disorders, advancements in biopsy technologies, and rising awareness of bone health. These projections suggest a promising future for the industry, driven by both technological and demographic trends.

Expanding Applications in Oncology

The Global Bone Biopsy Market Industry is witnessing an expansion in applications, particularly in oncology. Bone biopsies are increasingly utilized for diagnosing metastatic cancers and assessing treatment responses. As the global cancer burden rises, the need for accurate diagnostic tools becomes more critical. For example, bone metastases occur in approximately 70% of patients with advanced breast or prostate cancer, necessitating effective biopsy procedures. This trend indicates a growing market potential, as healthcare providers seek reliable methods for cancer diagnosis and management, further driving the industry's growth.

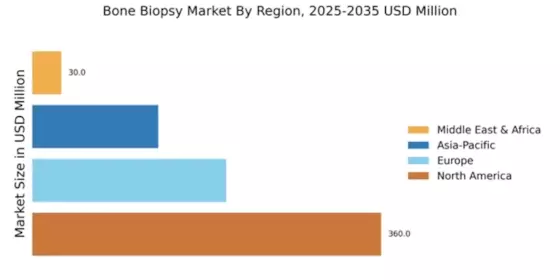

Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure and funding for diagnostic procedures are positively influencing the Global Bone Biopsy Market Industry. Various countries are investing in healthcare systems to enhance access to advanced diagnostic tools, including bone biopsies. For instance, national health programs that allocate funds for cancer diagnosis and treatment are likely to increase the availability of bone biopsy services. This support from governments may lead to a more robust market environment, facilitating growth and innovation within the industry.

Increasing Incidence of Bone Disorders

The Global Bone Biopsy Market Industry is experiencing growth driven by the rising prevalence of bone disorders such as osteoporosis and bone cancers. As populations age, the incidence of these conditions increases, necessitating diagnostic procedures like bone biopsies. For instance, osteoporosis affects approximately 200 million women worldwide, highlighting the need for effective diagnostic tools. This trend is expected to contribute to the market's expansion, with the industry projected to reach 0.72 USD Billion in 2024, indicating a growing demand for bone biopsy procedures.

Rising Awareness and Screening Programs

Growing awareness regarding bone health and the importance of early diagnosis is propelling the Global Bone Biopsy Market Industry. Public health initiatives and screening programs aimed at detecting bone-related diseases are becoming more prevalent. For instance, campaigns promoting osteoporosis screening have led to increased patient referrals for bone biopsies. This heightened awareness is likely to drive demand for diagnostic procedures, contributing to the market's growth trajectory. By 2035, the industry is projected to reach 1.3 USD Billion, underscoring the impact of awareness on the adoption of bone biopsy techniques.

Technological Advancements in Biopsy Techniques

Innovations in biopsy techniques are significantly influencing the Global Bone Biopsy Market Industry. The introduction of minimally invasive procedures and advanced imaging technologies enhances the accuracy and safety of bone biopsies. For example, the use of ultrasound-guided biopsies allows for real-time imaging, improving the precision of needle placement. These advancements not only improve patient outcomes but also increase the efficiency of the procedures, potentially leading to a higher adoption rate. As a result, the market is anticipated to grow at a CAGR of 5.54% from 2025 to 2035, reflecting the positive impact of technology on the industry.