Recloser Size

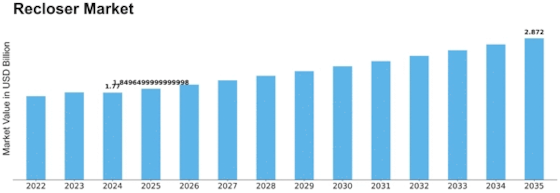

Recloser Market Growth Projections and Opportunities

One essential driver is the rising worldwide interest for dependable and continuous power supply. As businesses and social orders become more subject to power, the requirement for proficient and robotized frameworks to oversee power dissemination and limit personal time becomes central. Reclosers, with their capacity to consequently hinder and reestablish power stream, address this need, driving market development. Besides, the developing accentuation on environmentally friendly power sources assumes a vital part in molding the Recloser Market. The mix of sustainable power, for example, sun based and wind, into the power framework presents changeability and irregularity. Reclosers, furnished with cutting edge detecting and control capacities, add to network solidness by rapidly answering issues and unsettling influences, guaranteeing a smooth and dependable power supply notwithstanding fluctuating energy inputs. Consistence with these guidelines frequently requires utilities and administrators to put resources into present day recloser innovations that fulfill or surpass execution guidelines. This administrative push goes about as an impetus for the reception of cutting edge recloser arrangements, subsequently driving market development. Extreme rivalry encourages development as organizations endeavor to separate themselves by offering upgraded highlights, better execution, and financially savvy arrangements. Market players put vigorously in innovative work to remain ahead, prompting the presentation of brilliant reclosers with correspondence capacities, self-recuperating organizations, and further developed issue discovery components. Areas encountering quick urbanization and industrialization witness an expanded interest for solid power foundation. The requirement for modernization and development of existing power appropriation networks drives the reception of reclosers. Moreover, regions inclined to outrageous weather patterns, like tempests and typhoons, provoke an interest for reclosers with hearty plan and flexibility to endure cruel ecological components. The rising interest for solid power supply, combined with the incorporation of sustainable power sources, administrative drives, cutthroat elements, and monetary contemplations, all add to the developing scene of the Recloser Market. As innovation proceeds to progress, and the worldwide energy scene changes, the job of reclosers in guaranteeing a versatile and productive power dispersion framework is supposed to turn out to be much more conspicuous.

Leave a Comment