Reciprocating Compressor Size

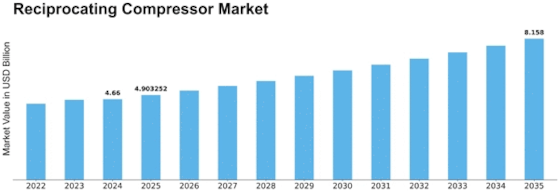

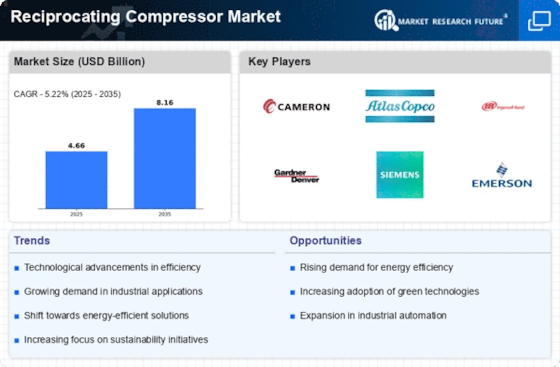

Reciprocating Compressor Market Growth Projections and Opportunities

Various market factors act as forces that influence the reciprocating compressor industry, such dynamics and performance. The increasing demand for reciprocating compressors across different industries also acts as a major driver of the market. Some of these compressors are critical to multiple applications such as in oil & gas, petrochemicals, chemicals, and manufacturing where efficient compression of gases is necessary. As these sectors grow and advance, the need for reciprocating compressors will continue to increase with market growth. Another major market dynamics is the global energy landscape. Due to the growing importance of energy efficiency and sustainability, industries are increasingly installing reciprocating compressors because they operate reliably. These compressors can work with multiple types of gases and can perform under various circumstances, making them the preferred units used by industries involved in decreasing energy usage and pollution. Technological innovations are another important factor influencing the reciprocating compressor market. Innovations are generated from continuous research and development activities on these compressors, which improve efficiency; performance reliability. Smart technologies, including IoT and better control systems integrate with the reciprocating compressors to make them more dynamic for changes in operating conditions. This technological change attracts companies seeking latest solutions to enhance their process efficiency. The reciprocating compressor market is very much affected by the landscape of economics and capital investments on various industries. Compressed air investments are boosted by economic growth, industrial development along with infrastructure enablement for gas applications such as transmission storage and processing. On the other hand, economic declines or uncertainties may result in investment slowdown and hence affect market. It is vital for businesses working in the reciprocating compressor market to comprehend and adapt themselves these economic factors. Regardless of market regulations and environmental policies affect the reciprocating compressor industry. Emission and environmental impact regulations make industries to invest in compressors that meet these standards. This results in an increasing requirement for green and low emission reciprocating compressors congruent with global endeavours to combat climate change as well as reduce carbon footprint. Secondly, the forces influencing the competitive landscape of reciprocating compressor market include mergers and acquisitions as well as partnerships by leading competitors. These actions help companies to improve their market share, increase the number of products that they offer, and use synergies to gain competitive advantage. Salient factors impacting the competition dynamics in this market include customer preferences, regional trends affecting the markets and competitive prices.

Leave a Comment