North America : Market Leader in Innovation

North America continues to lead the Real-time Supply Chain Monitoring Services Market, holding a significant market share of 6.0 in 2024. The region's growth is driven by rapid technological advancements, increasing demand for real-time data analytics, and stringent regulatory frameworks that promote transparency and efficiency in supply chains. Companies are increasingly adopting these services to enhance operational efficiency and reduce costs, further fueling market expansion.

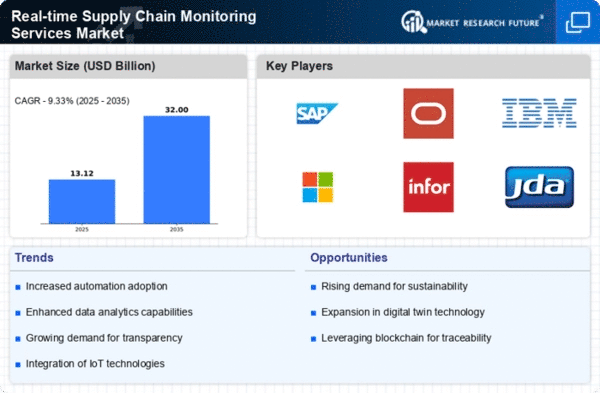

The competitive landscape in North America is robust, featuring key players such as SAP, Oracle, and IBM, which are at the forefront of innovation. The U.S. remains the largest market, supported by a strong infrastructure and a high concentration of technology firms. Canada is also emerging as a significant player, with companies like Kinaxis leading the charge in supply chain optimization. The presence of these industry giants ensures a dynamic market environment, fostering continuous improvement and innovation.

Europe : Growing Demand for Efficiency

Europe is witnessing a growing demand for Real-time Supply Chain Monitoring Services, with a market size of 3.0 in 2024. The region's growth is propelled by increasing regulatory requirements aimed at enhancing supply chain transparency and sustainability. European companies are investing in advanced technologies to comply with these regulations, driving the adoption of real-time monitoring solutions to improve operational efficiency and reduce waste.

Leading countries in this region include Germany, France, and the UK, where major players like SAP and Oracle are actively expanding their market presence. The competitive landscape is characterized by a mix of established firms and innovative startups, fostering a vibrant ecosystem for supply chain solutions. The European market is also influenced by initiatives from the European Union aimed at promoting digital transformation in logistics and supply chain management.

Asia-Pacific : Emerging Market Potential

Asia-Pacific is emerging as a significant player in the Real-time Supply Chain Monitoring Services Market, with a market size of 2.5 in 2024. The region's growth is driven by rapid industrialization, increasing e-commerce activities, and a growing focus on supply chain efficiency. Governments are also implementing policies to support digital transformation in logistics, which is further propelling the demand for real-time monitoring solutions.

Countries like China, Japan, and India are leading the charge, with a growing number of local and international players entering the market. The competitive landscape is becoming increasingly dynamic, with companies like IBM and Microsoft investing heavily in the region. The presence of a large consumer base and the rise of smart technologies are expected to drive further growth in the coming years, making Asia-Pacific a key market for supply chain innovations.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region is still in the nascent stages of adopting Real-time Supply Chain Monitoring Services, with a market size of 0.5 in 2024. However, the region presents significant untapped opportunities driven by increasing investments in infrastructure and logistics. Governments are recognizing the importance of efficient supply chains and are implementing policies to enhance operational capabilities, which is expected to boost market growth in the coming years.

Countries like the UAE and South Africa are leading the way in adopting these technologies, with a growing number of local firms entering the market. The competitive landscape is characterized by a mix of global players and emerging local companies. As the region continues to develop its logistics capabilities, the demand for real-time monitoring solutions is anticipated to rise, paving the way for future growth in this sector.