Market Share

Real Time Health Monitoring Devices Market Share Analysis

The partnership trend among companies has opened doors for new businesses looking to enter the real-time health monitoring device market. By forming alliances, companies can seize the opportunity to tap into this growing market. The collaborations between major players are not only driving the market but also presenting a promising avenue for newcomers. A prime example is the collaboration between BioTelemetry and Well Bridge Health Inc. This partnership aims to commercialize an innovative approach to managing and remotely monitoring patients with Congestive Heart Failure (CHF). Similarly, Qualcomm's health-focused subsidiary, Qualcomm Life, joined forces with AMC Health to integrate its 2net platform with AMC's CareConsole system. This collaboration resulted in a solution for managing chronic care beyond hospital boundaries, both at home and on the go.

The introduction of real-time health monitoring devices in developing economies is set to propel the growth of this market. The demand for these devices is on the rise in developing countries, particularly in Asia-Pacific and many Middle-East and African nations. The World Health Organization (WHO) and the International Telecommunication Union (ITU) collaborated to create a National e-Health roadmap toolkit. This toolkit aims to support connected healthcare and its strategic development in member states. Developing countries near the equator are grappling with various diseases such as Chagas, dengue, leprosy, and rabies. Mobile health (mhealth) device applications are expected to play a crucial role in controlling these diseases. These applications can expand treatment outreach, assist patients in adhering to medical regimens, and raise awareness about epidemics.

The growth of the global real-time health monitoring device market hinges on widespread network coverage and access to mobile devices. With network coverage expanding rapidly worldwide, there is a heightened demand for consumer usage, and policies are being implemented to stimulate growth in telecommunications infrastructure. Several governments in developing countries have initiated education programs and projects, such as the Janala Project in Bangladesh, ProjectABC in Nigeria, Tostan in Senegal, Yoza in South Africa, and BridgeIT in Tanzania, among others. These programs aim to enhance literacy and create awareness about health, contributing to an improved understanding among the population and increasing the likelihood of technological maturity.

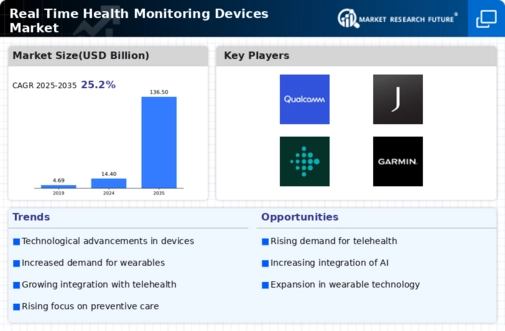

In summary, the growing trend of partnerships among companies is providing a gateway for new firms to enter the real-time health monitoring device market. The increasing demand for these devices in developing economies, coupled with strategic collaborations and initiatives, is driving the growth of the global market. As technology continues to advance and connectivity becomes more widespread, the potential for real-time health monitoring devices to make a significant impact on healthcare outcomes globally is substantial.

Leave a Comment