Market Trends

Key Emerging Trends in the Reactive Diluents Market

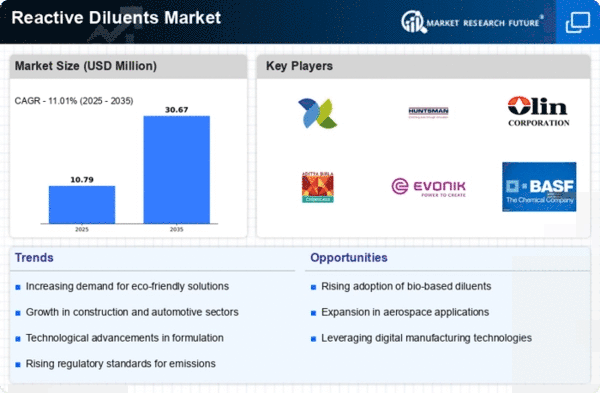

The market trends of reactive diluents have witnessed significant developments, reflecting a dynamic landscape driven by diverse factors. Reactive diluents play a crucial role in various industries, particularly in the coatings, adhesives, and composites sectors. One prominent trend shaping the market is the growing demand for eco-friendly and sustainable solutions. As environmental concerns continue to gain prominence, industries are actively seeking reactive diluents that not only enhance performance but also adhere to stringent environmental regulations.

In recent years, there has been a noticeable shift towards water-based formulations, driven by the desire to reduce volatile organic compound (VOC) emissions. This shift is directly impacting the market for reactive diluents, as manufacturers focus on developing waterborne formulations that incorporate these diluents to meet the demand for environmentally friendly products. The market is witnessing a surge in research and development activities to create reactive diluents that offer low toxicity, low VOC content, and improved overall sustainability.

Another key trend in the reactive diluents market is the increasing emphasis on innovation and customization. Industries are seeking tailor-made solutions to meet specific application requirements, driving manufacturers to invest in advanced technologies and formulations. Customized reactive diluents not only enhance the performance of end products but also contribute to cost-effectiveness by optimizing the overall production process. This trend is fostering collaborations between manufacturers and end-users to co-create solutions that address unique challenges in various industries.

Globalization has also played a pivotal role in shaping market trends for reactive diluents. The interconnectedness of markets has led to increased competition, prompting manufacturers to expand their product portfolios and geographical reach. The demand for high-performance reactive diluents is not limited to specific regions, and manufacturers are strategically positioning themselves to cater to a global customer base. This has resulted in the establishment of partnerships, mergers, and acquisitions to strengthen market presence and gain a competitive edge.

Furthermore, the market is witnessing a rise in the adoption of novel reactive diluents in emerging industries, such as 3D printing and electronic materials. The versatility of reactive diluents makes them suitable for a wide range of applications beyond traditional industries. As these emerging sectors continue to grow, the demand for specialized reactive diluents is expected to increase, creating new opportunities for market players.

Despite the positive outlook, challenges persist in the reactive diluents market. Fluctuating raw material prices and the dependency on petrochemical feedstocks can impact production costs, influencing market dynamics. Additionally, stringent regulatory requirements regarding chemical safety and health hazards pose challenges for manufacturers in terms of compliance and product development. Market players are investing in research to develop bio-based and renewable sources for reactive diluents to address these challenges and contribute to the overall sustainability of the industry.

Leave a Comment