Growing Emphasis on Safety Standards

Safety remains a paramount concern within the Railway Coupler Market, driving the demand for couplers that meet stringent safety standards. Recent trends indicate that railway operators are increasingly prioritizing safety in their procurement processes, leading to a heightened focus on coupler reliability and performance. Data shows that regions with rigorous safety regulations have reported a 25% decrease in accidents related to coupler failures. This emphasis on safety is prompting manufacturers to invest in research and development to create couplers that not only comply with existing standards but also exceed them. As safety regulations continue to evolve, the market for high-performance couplers is expected to expand, reflecting the industry's commitment to ensuring safe rail operations.

Technological Innovations in Coupler Design

Technological innovations are reshaping the Railway Coupler Market, leading to the development of more efficient and durable couplers. Advances in materials science and engineering have resulted in the creation of lightweight yet robust couplers that enhance the overall performance of rail systems. For example, the introduction of composite materials has reduced the weight of couplers by up to 30%, which in turn improves fuel efficiency and reduces wear on rail infrastructure. Furthermore, the integration of smart technologies, such as sensors for real-time monitoring, is becoming increasingly prevalent. These innovations not only enhance safety but also optimize maintenance schedules, thereby reducing operational costs. As the industry continues to embrace these technological advancements, the demand for innovative coupler solutions is likely to escalate.

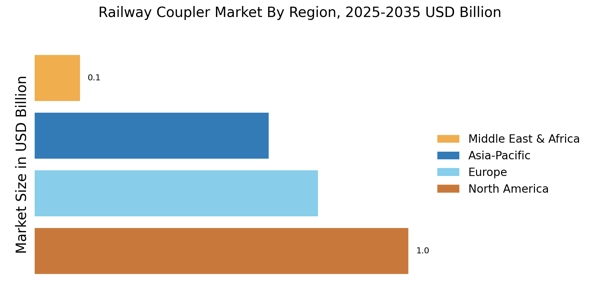

Regulatory Support for Railway Infrastructure

The Railway Coupler Market benefits from robust regulatory support aimed at enhancing railway infrastructure. Governments worldwide are implementing policies that promote the development and maintenance of rail networks. This regulatory environment encourages investments in new technologies, including advanced couplers that improve safety and operational efficiency. Recent statistics suggest that countries with supportive regulatory frameworks have seen a 20% increase in railway project approvals. Such policies not only facilitate the adoption of innovative coupler designs but also ensure compliance with safety standards, thereby fostering a more reliable railway system. As regulatory bodies continue to prioritize railway enhancements, the demand for high-quality couplers is expected to rise, further propelling market growth.

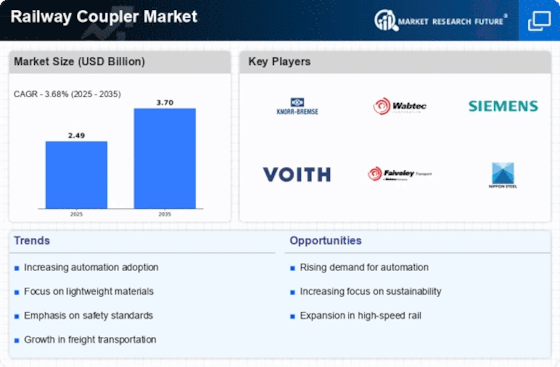

Increasing Demand for Efficient Transportation

The Railway Coupler Market is experiencing a surge in demand for efficient transportation solutions. As urbanization accelerates, the need for reliable and swift rail services becomes paramount. This trend is reflected in the rising investments in railway infrastructure, with many countries allocating substantial budgets for modernization projects. For instance, recent data indicates that railway investments have increased by approximately 15% over the past year, highlighting the industry's commitment to enhancing operational efficiency. Couplers play a critical role in ensuring seamless connectivity between rail cars, thereby facilitating smoother operations. Consequently, the growing emphasis on efficient transportation systems is likely to drive the demand for advanced coupler technologies, which are essential for meeting the evolving needs of the railway sector.

Expansion of Rail Networks in Emerging Economies

The Railway Coupler Market is poised for growth due to the expansion of rail networks in emerging economies. Many developing nations are investing heavily in their railway infrastructure to support economic growth and improve connectivity. Recent reports indicate that railway construction projects in these regions have increased by over 30% in the last two years, driven by the need for efficient transportation solutions. Couplers are essential components in these new rail systems, as they facilitate the connection between various rail cars. As emerging economies continue to prioritize railway development, the demand for reliable and innovative coupler solutions is likely to rise, presenting significant opportunities for manufacturers in the Railway Coupler Market.