North America : Market Leader in MRO Services

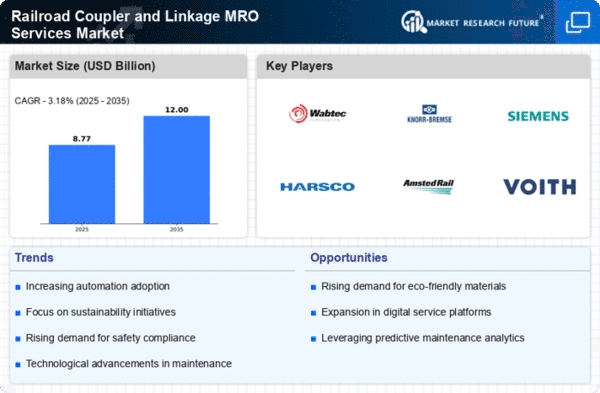

North America is poised to maintain its leadership in the Railroad Coupler and Linkage MRO Services Market, holding a significant market share of 4.25 in 2024. The region's growth is driven by increasing freight transport demand, stringent safety regulations, and investments in rail infrastructure. The U.S. government has been proactive in enhancing rail safety standards, which further fuels the demand for MRO services. The competitive landscape in North America is robust, featuring key players such as Wabtec Corporation, Harsco Corporation, and Amsted Rail Company. These companies are leveraging advanced technologies and strategic partnerships to enhance service offerings. The presence of established rail networks and ongoing modernization projects in the U.S. and Canada contribute to a favorable environment for MRO services, ensuring sustained growth in the region.

Europe : Emerging Market with Growth Potential

Europe's Railroad Coupler and Linkage MRO Services Market is valued at 2.5, reflecting a growing emphasis on rail infrastructure revitalization. The region is witnessing increased investments in rail networks, driven by the European Union's commitment to sustainable transport solutions. Regulatory frameworks are evolving to support modernization, enhancing safety and efficiency in rail operations. Leading countries such as Germany, France, and the UK are at the forefront of this market, with key players like Knorr-Bremse AG and Siemens Mobility driving innovation. The competitive landscape is characterized by collaborations and technological advancements aimed at improving service delivery. As Europe transitions towards greener transport solutions, the demand for MRO services is expected to rise significantly, positioning the region for future growth.

Asia-Pacific : Rapidly Growing MRO Services Sector

The Asia-Pacific region, with a market size of 1.75, is rapidly emerging as a key player in the Railroad Coupler and Linkage MRO Services Market. The growth is fueled by increasing urbanization, rising freight transport needs, and government initiatives aimed at enhancing rail infrastructure. Countries like China and India are investing heavily in rail modernization, which is expected to drive demand for MRO services in the coming years. China stands out as a leader in rail infrastructure development, with significant contributions from companies like Toshiba Infrastructure Systems & Solutions Corporation and Nippon Steel Corporation. The competitive landscape is evolving, with local and international players vying for market share. As the region continues to expand its rail networks, the demand for efficient MRO services will likely see substantial growth, making it a focal point for investment.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region, with a market size of 0.5, presents untapped opportunities in the Railroad Coupler and Linkage MRO Services Market. The growth is primarily driven by ongoing investments in rail infrastructure, particularly in countries like South Africa and the UAE. Governments are increasingly recognizing the importance of rail transport for economic development, leading to enhanced funding and regulatory support for MRO services. The competitive landscape is still developing, with a few key players beginning to establish their presence. Local companies are collaborating with international firms to leverage expertise and technology. As rail networks expand and modernize, the demand for MRO services is expected to grow, making this region a potential hotspot for future investments.