Focus on Cost Efficiency

Cost efficiency is becoming a pivotal concern within the Radiology Information System Market. Healthcare providers are under constant pressure to reduce operational costs while maintaining high-quality patient care. As a result, there is a growing interest in radiology information systems that offer integrated solutions to streamline workflows and reduce redundancies. By automating various processes, these systems can help facilities save time and resources, ultimately leading to lower operational costs. Market projections suggest that the demand for cost-effective radiology solutions will continue to rise, as organizations seek to optimize their resources and improve financial performance.

Increase in Chronic Diseases

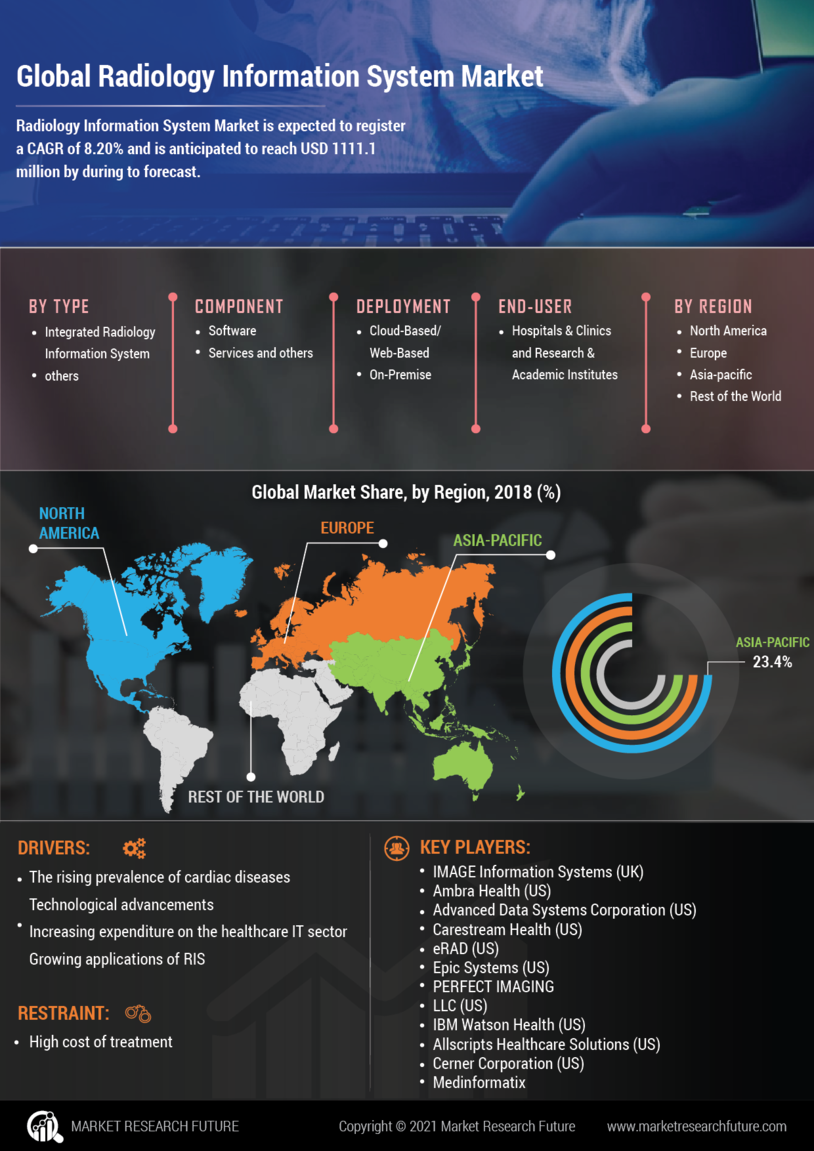

The rising prevalence of chronic diseases is a major driver for the Radiology Information System Market. Conditions such as cancer, cardiovascular diseases, and neurological disorders necessitate frequent imaging studies for diagnosis and monitoring. This growing patient population is leading to an increased demand for efficient radiology services and, consequently, advanced radiology information systems. Market analysis indicates that the incidence of chronic diseases is expected to rise, which will likely result in a corresponding increase in imaging procedures. This trend underscores the critical role of radiology information systems in managing patient data and improving the overall efficiency of healthcare delivery.

Growing Demand for Telemedicine

The rise of telemedicine is reshaping the Radiology Information System Market, as healthcare providers seek to offer remote diagnostic services. This shift is particularly relevant in rural and underserved areas where access to radiology services is limited. The integration of tele-radiology solutions allows for timely consultations and interpretations, thereby enhancing patient care. Market data suggests that the telemedicine sector is expected to grow at a compound annual growth rate of over 20% in the coming years. This growth is likely to drive the demand for advanced radiology information systems that can support remote access and data sharing, further solidifying the importance of these systems in modern healthcare.

Regulatory Compliance and Standards

The Radiology Information System Market is significantly influenced by the need for compliance with regulatory standards and guidelines. Healthcare organizations are increasingly required to adhere to stringent regulations regarding patient data management, privacy, and security. This has led to a heightened demand for radiology information systems that not only meet these compliance requirements but also enhance operational efficiency. The market is witnessing a shift towards solutions that incorporate robust data security features and facilitate seamless reporting to regulatory bodies. As organizations strive to avoid penalties and ensure patient trust, the emphasis on compliance is likely to propel the growth of the Radiology Information System Market.

Technological Advancements in Imaging

The Radiology Information System Market is experiencing a surge in demand due to rapid technological advancements in imaging modalities. Innovations such as 3D imaging, digital radiography, and advanced MRI techniques are enhancing diagnostic accuracy and efficiency. These advancements not only improve patient outcomes but also streamline workflows within radiology departments. As healthcare providers increasingly adopt these technologies, the market is projected to grow significantly. According to recent estimates, the market could reach a valuation of over 1 billion USD by 2026, driven by the need for more precise imaging solutions. This trend indicates a robust future for the Radiology Information System Market, as facilities seek to integrate cutting-edge technologies to remain competitive.