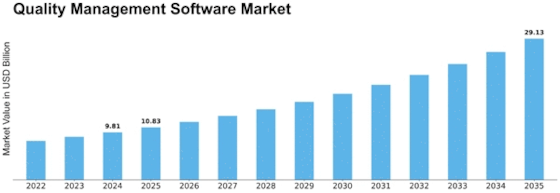

Quality Management Software Size

Quality Management Software Market Growth Projections and Opportunities

The Quality Management Software (QMS) market is vigorously impacted by different market factors that assume a significant part in forming its elements. One of the key drivers pushing the development of the QMS market is the rising accentuation on quality affirmation and consistence across ventures. As organizations endeavor to meet severe administrative prerequisites and convey excellent items and administrations, the interest for powerful QMS arrangements keeps on flooding.

Mechanical headways likewise contribute altogether to the advancement of the QMS market. With the fast incorporation of inventive advancements, for example, man-made consciousness, AI, and the Web of Things (IoT), QMS arrangements are turning out to be more modern and equipped for tending to complex quality management challenges. Mechanization highlights implanted in QMS software smooth out processes, improve productivity, and limit the gamble of blunders, accordingly interesting to associations hoping to upgrade their quality control systems.

The worldwide idea of business activities is another market factor forming the QMS scene. As organizations extend their span across borders, the requirement for normalized and brought together quality management rehearses becomes fundamental. QMS software gives a brought together stage to associations to implement steady quality norms and guarantee consistence across different geological areas and specialty units.

Moreover, the rising familiarity with the meaning of information driven direction is impacting the reception of QMS arrangements. These software stages not just work with the assortment and investigation of quality-related information yet additionally give significant experiences that engage associations to pursue informed choices. The information driven approach empowers organizations to distinguish patterns, foresee expected issues, and execute preventive measures, adding to generally speaking functional greatness.

Cost contemplations are likewise instrumental in molding the QMS market scene. At first saw as a significant speculation, the drawn out advantages of carrying out QMS software, like better proficiency, decreased revamp, and limited consistence gambles, offset the underlying expenses. As associations perceive the profit from venture and the potential for cost investment funds through viable quality management, the reception of QMS arrangements turns into an essential choice for maintainable business development.

Leave a Comment