Increased Pest Resistance

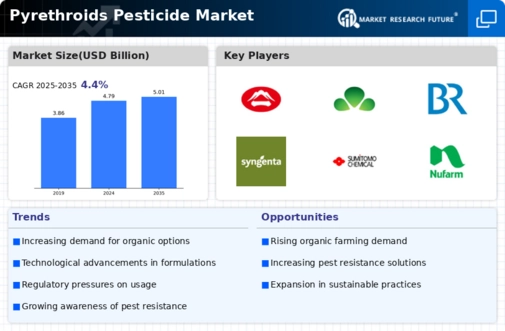

The emergence of pest resistance to conventional pesticides is a critical factor influencing the Pyrethroids Pesticide Market. As pests adapt to traditional chemical controls, farmers are compelled to seek alternative solutions that can effectively manage pest populations. Pyrethroids, known for their rapid action and effectiveness against a wide range of pests, are increasingly favored. Market analysis indicates that the pest control market is expected to grow at a compound annual growth rate of 5% over the next five years. This trend suggests that the Pyrethroids Pesticide Market will likely benefit from the need for reliable pest management strategies.

Rising Demand for Organic Produce

The increasing consumer preference for organic produce is driving the Pyrethroids Pesticide Market. As consumers become more health-conscious, they seek food products that are free from synthetic chemicals. Pyrethroids, being derived from natural sources, are perceived as safer alternatives to traditional pesticides. This shift in consumer behavior is reflected in market data, indicating a steady growth in organic farming practices. In 2023, the organic food market was valued at approximately 50 billion USD, with projections suggesting continued expansion. Consequently, the demand for effective pest control solutions, such as pyrethroids, is likely to rise, further propelling the Pyrethroids Pesticide Market.

Regulatory Support for Biopesticides

The regulatory landscape is evolving to support the use of biopesticides, including pyrethroids, which is positively influencing the Pyrethroids Pesticide Market. Governments are increasingly recognizing the need for sustainable pest management solutions that align with environmental protection goals. Recent policy changes have streamlined the approval process for biopesticides, making it easier for manufacturers to bring pyrethroid products to market. This regulatory support is expected to enhance market access and stimulate growth. As of 2023, the biopesticide market was valued at over 10 billion USD, with projections indicating a robust growth trajectory. The Pyrethroids Pesticide Market stands to gain from this favorable regulatory environment.

Technological Innovations in Agriculture

Technological advancements in agricultural practices are significantly impacting the Pyrethroids Pesticide Market. Innovations such as precision agriculture and integrated pest management are enhancing the efficiency of pesticide application. These technologies allow for targeted use of pyrethroids, minimizing waste and maximizing effectiveness. Data from agricultural technology reports indicate that the adoption of precision farming techniques is projected to increase by 15% annually. This trend not only improves crop yields but also promotes sustainable practices, thereby driving the demand for pyrethroids as a preferred pesticide option. The Pyrethroids Pesticide Market is poised to benefit from these advancements.

Growing Awareness of Pest Management Solutions

There is a growing awareness among farmers and agricultural stakeholders regarding the importance of effective pest management solutions, which is driving the Pyrethroids Pesticide Market. Educational initiatives and outreach programs are emphasizing the role of integrated pest management (IPM) strategies that incorporate pyrethroids. This heightened awareness is leading to increased adoption of pyrethroid-based products as part of comprehensive pest control plans. Market Research Future indicates that the demand for pest management solutions is expected to rise by 7% annually, reflecting a shift towards more informed agricultural practices. Consequently, the Pyrethroids Pesticide Market is likely to experience sustained growth as awareness continues to expand.

Leave a Comment