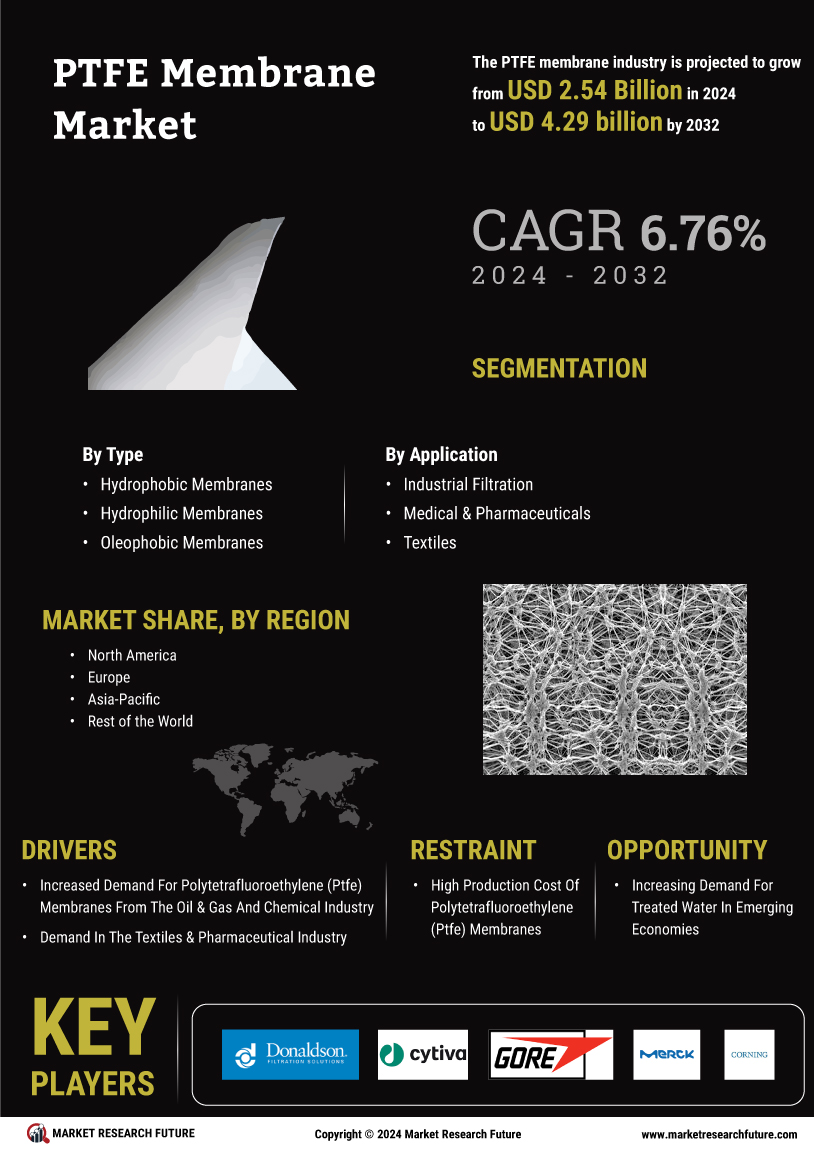

Leading market players are investing heavily in research and development to expand their product lines, which will help the PTFE membrane market, grow even more. Market participants are also undertaking various strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the PTFE membrane industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics manufacturers use in the PTFE membrane industry to benefit clients and increase the market sector. In recent years, the PTFE membrane industry has offered some of the most significant medical advantages. Major players in the PTFE membrane market, including Donaldson Company, Inc, Corning Incorporated, Porex Corporation, Cytiva, and others, are attempting to increase market demand by investing in research and development operations.

Cytiva is a biopharmaceutical instrument and consumables service provider that aims to enhance and accelerate treatments. The company provides process chromatography hardware, cell culture media, single-use technologies, development instrumentation, and consumables to support biopharmaceutical drug research, discovery, process development, and manufacturing workflows, allowing firms to work better, faster, and safer, resulting in better patient outcomes.

In January Cytiva announced the construction of a new 7,360 square meter facility in Grens, Switzerland, to produce single-use PTFE membrane kits, with the facility slated to be fully operational in 2022.

It will also be a 'Centre of Excellence' for Cytiva's Cell and Gene Therapy business and a platform for European customer training programs.

Merck & Co., Inc. is a healthcare corporation that provides health solutions through prescription medications, vaccines, biologic therapies, animal health, and consumer care goods that it offers directly and through joint ventures. The company operates in the pharmaceutical, animal health, and consumer care industries. The business is known as Merck Sharp & Dohme, or MSD, outside North America and Canada.

In July 2020, Merck, a prominent science and technology firm, announced plans to establish a new € 18 million laboratory facility in Buchs, Switzerland, to serve its rapidly developing PTFE membrane material business and to continue to drive innovation and increase analytical standards R&D. The company expects to create approximately two dozen employment.